Credit Card against Fixed Deposit is assured credit card which you can get easily against your fixed deposit. A credit card against a fixed deposit is beneficial to students, those who are on the starting phase of earning, those who have low income or salary, those who have a low credit score, those who want to build or repair credit score, etc. So if you are one of them, you can apply for Credit Card against a fixed deposit without any income documents.

When you apply for secured credit cards that are credit cards against fixed deposit, you don’t need to be worried about disapproval of your application as you are keeping your fixed deposit as a security to obtain a credit card you will be surely provided with a Credit Card.

There many banks in India which offers credit card against FD, so if you are planning to hold one then below we have arranged some of the best credit card against fixed deposit provided by leading banks in India and the process for applying.

Table of Contents

How to Apply for Axis Bank Credit Card against Fixed Deposit

If you want to apply for Credit Card against a fixed deposit in Axis Bank, first of all, you should have a bank account with them.

If you are having a bank account with them then you can walk-in into the branch and request them that you want to apply for Credit Card against a fixed deposit. If you don’t have a bank account in Axis Bank then you will have to open one account to apply for Credit Card against a fixed deposit. You will have to provide necessary documents like ID Proof, Proof of Address PAN Card, and Passport Size Photo to open your bank account.

When you request a bank that you want to apply for Credit Card against a fixed deposit, you will be asked to open a fixed deposit as per your need remember that your Credit Card Credit limit will limit up to 80% of the FD amount. So accordingly you will have to open a fixed deposit, if you have a fixed deposit already in the bank you can apply for Credit Card against a fixed deposit on that existing fixed deposit. (While opening Fixed Deposit and while applying for Credit Card against FD you will have to complete the necessary documentation process by the bank)

Once the fixed deposit is opened the bank will mark your fixed deposit as lien and you will be provided with Axis Bank Insta Easy Credit Card.

The Credit Card will usually get activated within 2 to 6 working days, and once Credit Card is activated you are ready to use it online or offline anywhere.

Apply for HDFC Credit Card against fixed deposit

The procedure to apply for HDFC Credit Card against Fixed Deposit is very simple, just you need to know the following facts before applying for HDFC Bank FD Card.

- You will have to open a minimum ₹20,000 Fixed Deposit in order to apply for FD Credit Card. The Credit Limit of your Credit Card will be 75% of your Fixed Deposit Amount

- Credit Card against FD in HDFC Bank doesn’t require any additional documents to be furnished like income proof, ITR, etc.

- You can’t close your fixed deposit until you surrender or close your Credit Card, as FD will be marked lien. Cardholders will continue earning interest on their fixed deposit

So now let’s get started with the procedure to apply for HDFC FD Card.

- Just visit the HDFC bank branch where you hold your HDFC Bank Account if you don’t have an HDFC Bank Account yet then you will have to open one.

- Ask the HDFC Bank Manager that you want to apply for FD Credit Card.

- They will ask you to open a Fixed Deposit, you can open a Fixed Deposit as per your need. Whatever amount Fixed Deposit you open you will get a 75% credit limit in your Credit Card, so think wisely and open.

- You can open Fixed Deposit Online via HDFC Net Banking or at the branch itself.

- Once opening the fixed deposit, HDFC Bank Manager will fill up your HDFC Bank Credit Card Application Form, and you will be asked to sign on the form wherever it is needed.

- Depending on your Fixed Deposit Amount and your Credit Limit of your Credit Card they will give you options to choose from HDFC Credit Card Variants.

- In my case, I booked 1 lac Fixed Deposit and my credit limit was ₹75,000 so they provided me option to choose from HDFC Freedom Cashback Credit Card, HDFC Bharat Cashback Credit Card, and HDFC Money-Back Credit Card.

- Depending on your usage pattern choose from the Credit Card options provided to you. The Bank Manager will tick mark the Credit Card Variant on the application form which you have applied.

- Once your application is received you will receive SMS on your phone saying “We acknowledge your HDFC Bank Credit Card Appln XXXXX check status on post 4 days under ref XXXXXX”

- So you can keep tracking your application by visiting HDFC Portal by entering your HDFC Credit Card Application Number which you received through SMS.

- In 15 to 20 working days from the day of the application, you will get your HDFC Bank FD Card delivered to your doorstep through courier.

ICICI Bank Credit Card against FD

There are two methods to apply for ICICI Bank FD Credit Card and they are via Net Banking and via visiting ICICI Branch. So in this post, we will discuss both these methods to apply for ICICI Bank Credit Card against FD. But before let us make you familiar with few important things about ICICI Bank FD Card.

- To apply for ICICI Bank Fixed Deposit Credit Card you will need to open a minimum 10,000 Fixed Deposit (depending on the card variant), the maximum amount is as per your wish and need.

- Your Credit Card limit will be 85% of your Fixed Deposit.

- Your fixed deposit will be under lien with ICICI Bank till you surrender your Credit Card or opt to close your Credit Card. You will not able to break your Fixed Deposit until then.

Types of FD Credit Card

| Credit Card variant | Minimum FD amount (₹) |

|---|---|

| ICICI Bank Instant Platinum Credit Card | 10000 |

| ICICI Bank Coral Credit Card | 30000 |

| ICICI Bank Rubyx Credit Card | 75000 |

So now let’s being with the process on how to apply for ICICI FD Credit Card.

Apply ICICI FD Credit Card Online via Net Banking

This is the easiest method for applying for ICICI Bank FD Credit Card without visiting the branch at the comfort at your home. But with this method you will not get your Credit Card Instantly, you will receive your card in 5 to 7 working days via courier.

- To apply for ICICI Bank Fixed Deposit Credit Card via Internet Banking just login into your Internet Banking account

- Just book a fixed deposit by going to Deposits > Open Fixed Deposit

- You will get an 85% Credit Limit on your Credit Card of the Fixed Deposit Amount, so make sure you plan it accordingly.

- Once you are done booking Fixed Deposit just navigate to Customer Service > Service Requests.

- From Service Requests page just select option Apply for a Credit Card against your Fixed Deposit under Credit Card Category.

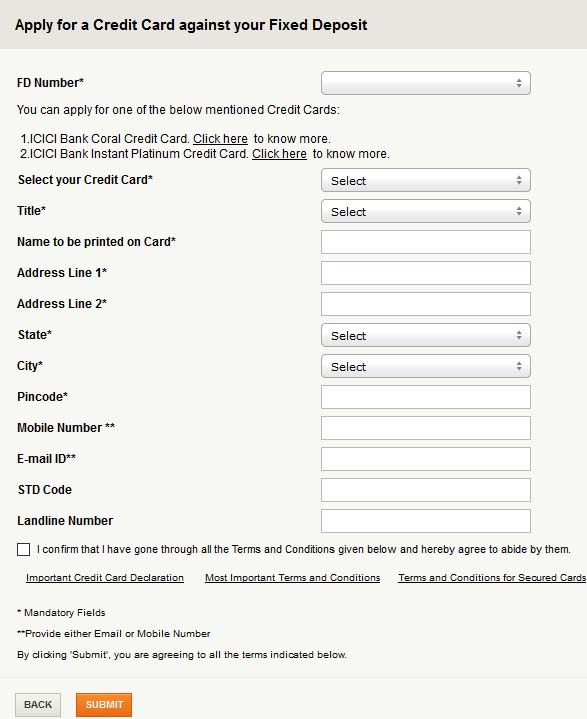

- Apply for a Credit Card against your Fixed Deposit page will load in which you will have to select your FD than Credit Card from two options which you want to apply and they are:

- ICICI Bank Instant Platinum Credit Card (Lifetime Free/ No Annual Fee / No Joining Fee)

- ICICI Bank Coral Credit Card (₹500 Joining Fee/ ₹500 Annual Fee)

- Select any one card which meets your requirements and enter your details like select title, enter a name to be printed on your card, address, state, city, pin code, mobile number, email id, STD code, landline number, accept the terms and conditions and click on submit button.

- On the next page, you will be asked to review your details if all details entered are correct just click on the submit button.

- On the next page, a message will be displayed saying your request has been successfully submitted and it will show your reference number.

That’s it, your ICICI Bank FD Credit Card will be delivered to you within 5 to 7 working days.

Apply for ICICI FD Credit Card by visiting Branch

- To apply for ICICI Bank FD Credit Card you should have an account in ICICI Bank if you don’t have it then you will have to open a bank account first.

- Visit your ICICI Branch and inquire about the branch manager about FD Credit Card.

- The branch manager will ask you to open a Fixed Deposit, just open Fixed Deposit according to how much credit you would like to have in your Credit Card.

- Once you book Fixed Deposit, ask the manager to apply for ICICI Bank FD Credit Card.

- You will be given two variants of the card to choose and they are ICICI Bank Instant Platinum Credit Card and ICICI Bank Coral FD Card.

- ICICI Bank Instant Platinum Credit Card is a lifetime free credit card which doesn’t have Joining Fee and Annual Fee, on another hand ICICI Bank Coral FD Credit Card is having Joining Fee of ₹500 and Annual Fee of ₹500. So select from any of these cards wisely according to your choice and usage.

- Once you select from the card the branch manager will take your request to apply for Credit Card against a Fixed deposit, and you will be asked to signature on necessary forms.

You will be provided with Instant Credit Card on the spot, your Credit Card will get activated in next 24 to 48 hours.

What are the Joining Fees & Annual Fees of Axis Insta Easy Credit Card against Fixed Deposit?

₹500 + tax will be charged from your Axis Insta Easy Credit Card as a joining fee after few days once your Credit Card gets activated, but the joining fee will be waived off if you spend ₹5000/- within the first 45 days of card issuance. There are no annual fees charged for Axis Bank FD Credit Card.

What is the Over Limit Penalty for Axis Bank FD Card?

If you spend over the limit of your card you will be charged a penalty 3% of the over-limit amount or Min. ₹500

If I open ₹20000 Fixed Deposit how much will be my Axis Credit Card Limit?

As me already mentioned in the above article that your Credit Card limit will be 80% of your FD amount, which means if you have opened FD of ₹20000 you will get Monthly Credit Limit on your Credit Card of ₹16000

Will my credit card stay active if I close the linked fixed deposit or after the maturity of the FD?

If you close your fixed deposit, your credit card will also be closed. And secondly the bank always book’s the fixed deposit on auto-renewal terms, so your fd will not close and will auto-renew on maturity. If you want to break your fd which is on lien then you will need to surrender the credit card which you have taken against the FD.

Nice Post. I was searching for the post. I went to bank but they told me to wait for two month saying that Bank will offer credit card on basis Of my account. Is it true?? Does axis bank offers credit card without fixed deposit…Thanks a lot again this post

Hello Md Aftab,

Yes you can also apply for Axis Credit Card’s directly without FD if you have handsome income.