Cheque Book can be required for various purposes like making payments, withdrawing money, verification purposes, etc. So today we will provide information as well as various methods available with which you can Request SBI Cheque Book or SBI Check Book Request. Normally when you open a new bank account with a cheque book facility enabled, you get the cheque book delivered on your postal address within 10 working days. And sometimes in some cases the cheque book comes included in the instant Kit of the bank which would be a non personalized cheque book.

But incase if you have not received a cheque book or suppose if you have consumed the cheque book you can apply or request a new SBI cheque book with name printed which is called personalized cheque through various methods like SBI Online Banking, SBI ATM and through SBI Branch. So below are the various methods briefly explained on how to place SBI Cheque Book Request.

Table of Contents

Place SBI Cheque Book Request Online through SBI Net Banking

To be able to place a SBI Cheque Book Request online through SBI Net Banking you should have this facility enabled, requesting SBI Cheque Book through Online SBI Net Banking is one of the easiest methods to get cheque book delivered to you as there will be no formality to fill up the form and in just a few clicks you will easily order SBI Cheque Book.

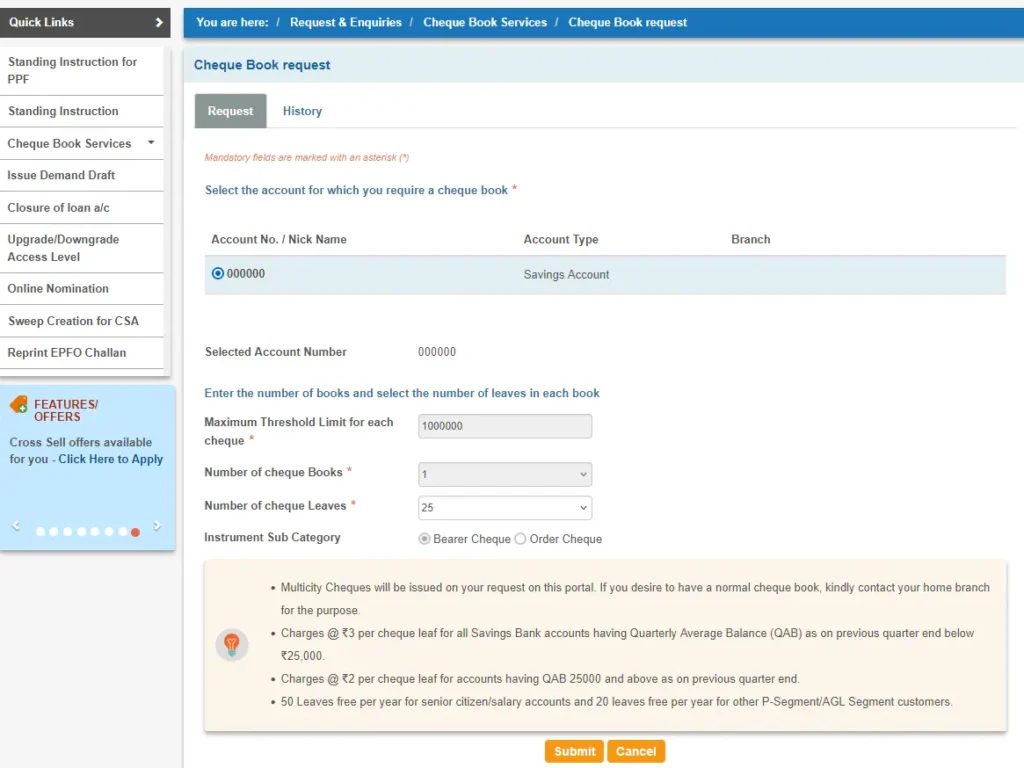

As per Bank’s policy, only Multicity Cheque Book is available for this account.

You can request for a cheque book for any of your accounts (Savings, Current, Cash Credit, Over Draft).

Bearer Cheque: A person holding the cheque can collect the amount if it is a bearer cheque.

Order Cheque: The payee (i.e. the person in whose favour the cheque is issued) only or his authorized person only can collect the amount of the cheque if it is an order cheque.

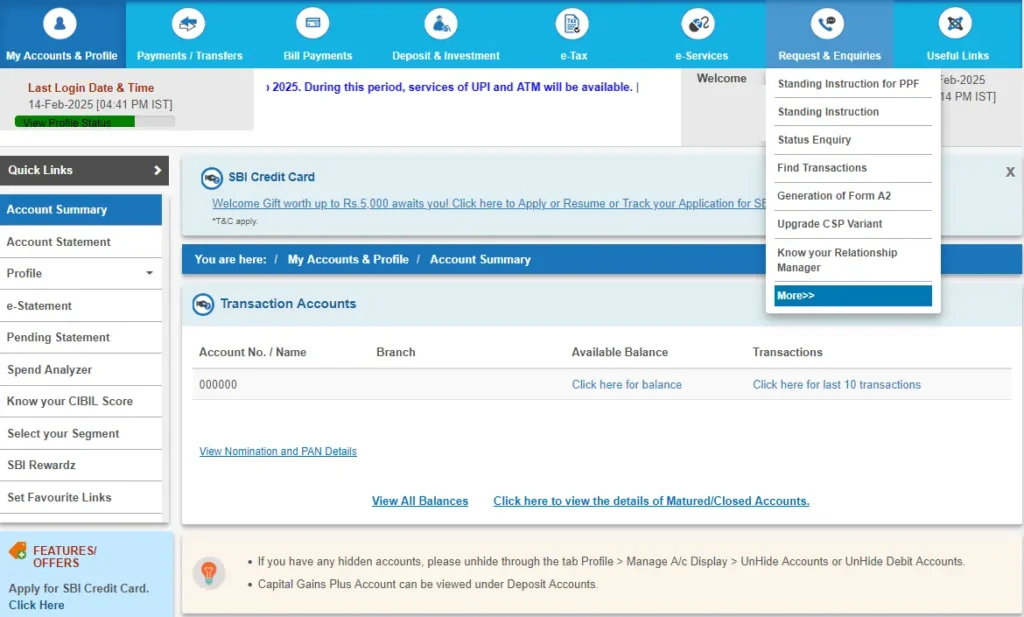

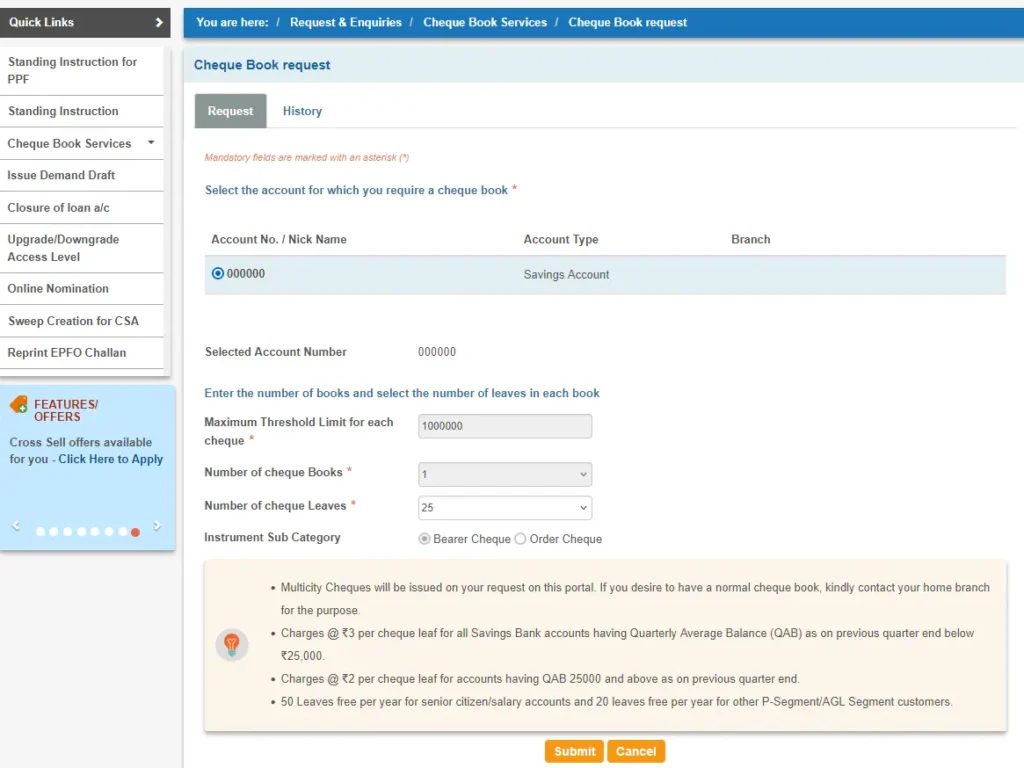

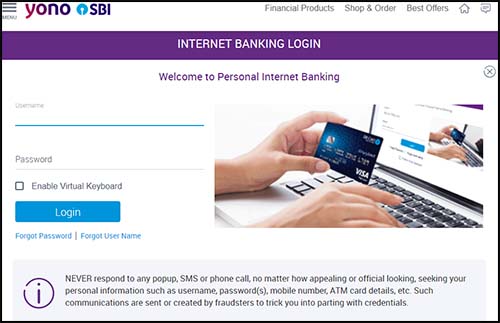

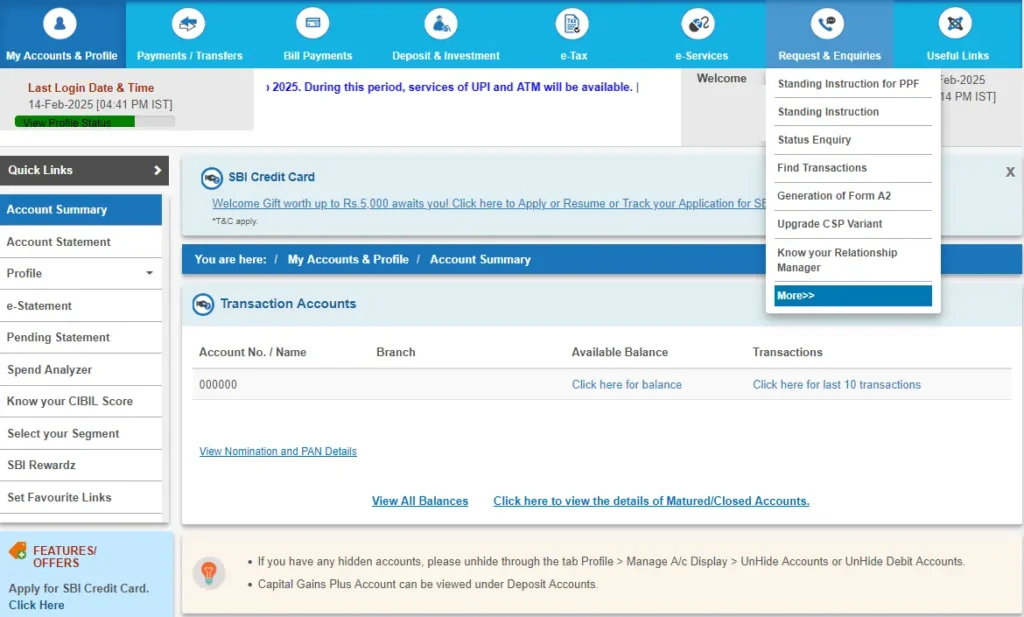

Log in to Online SBI Net Banking with your user id and password.

After you are logged in go to Request & Enquiries tab and click on the More>> option

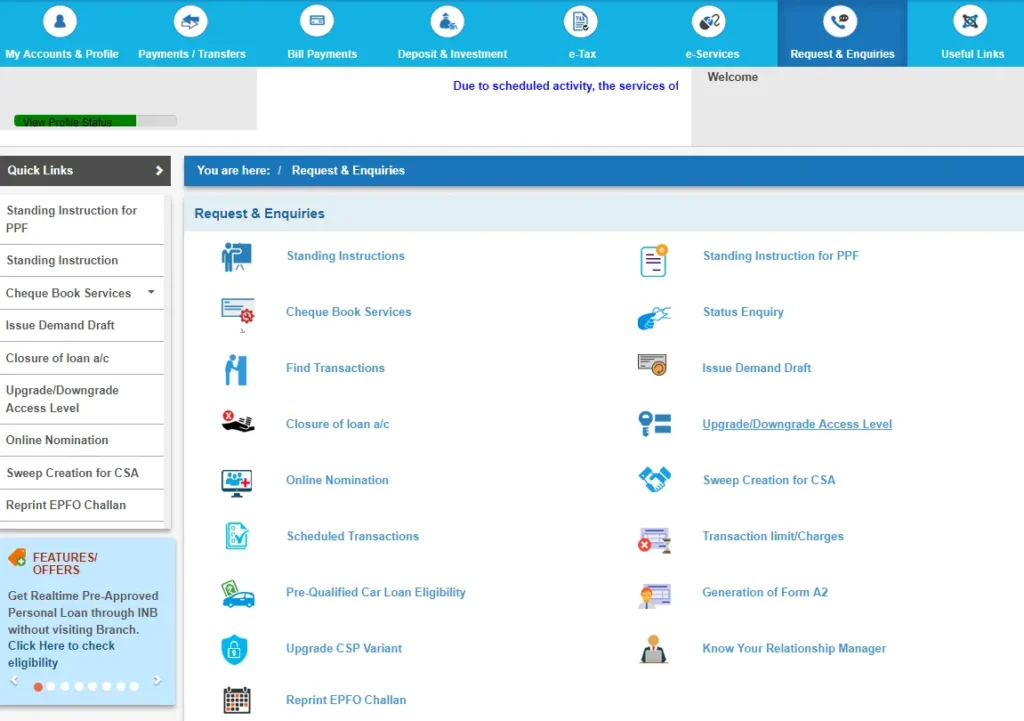

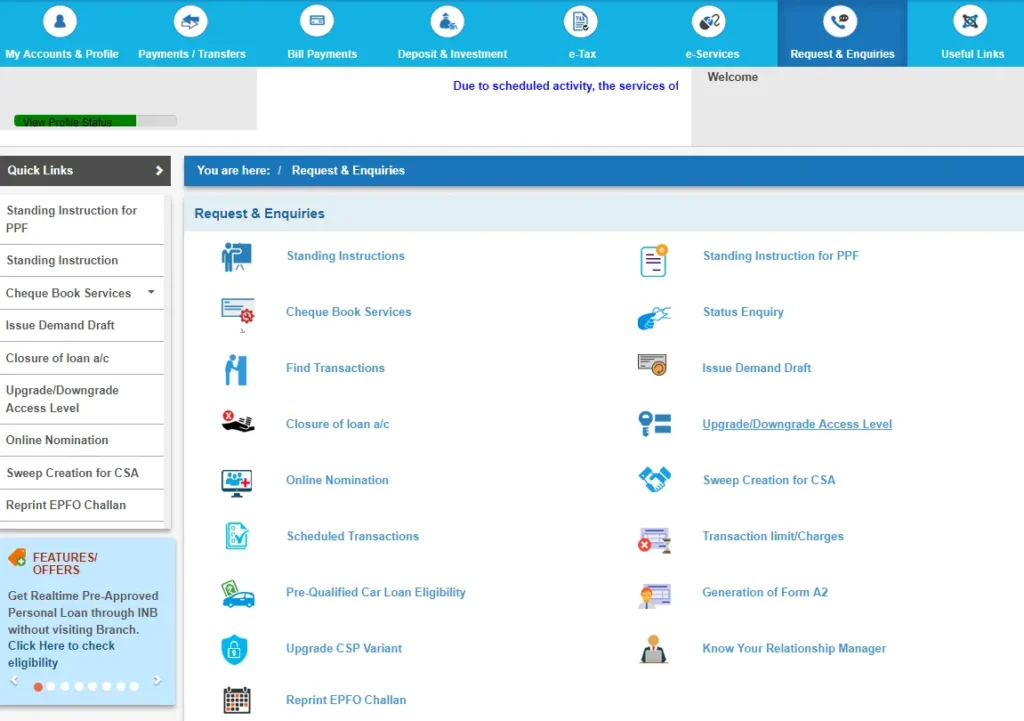

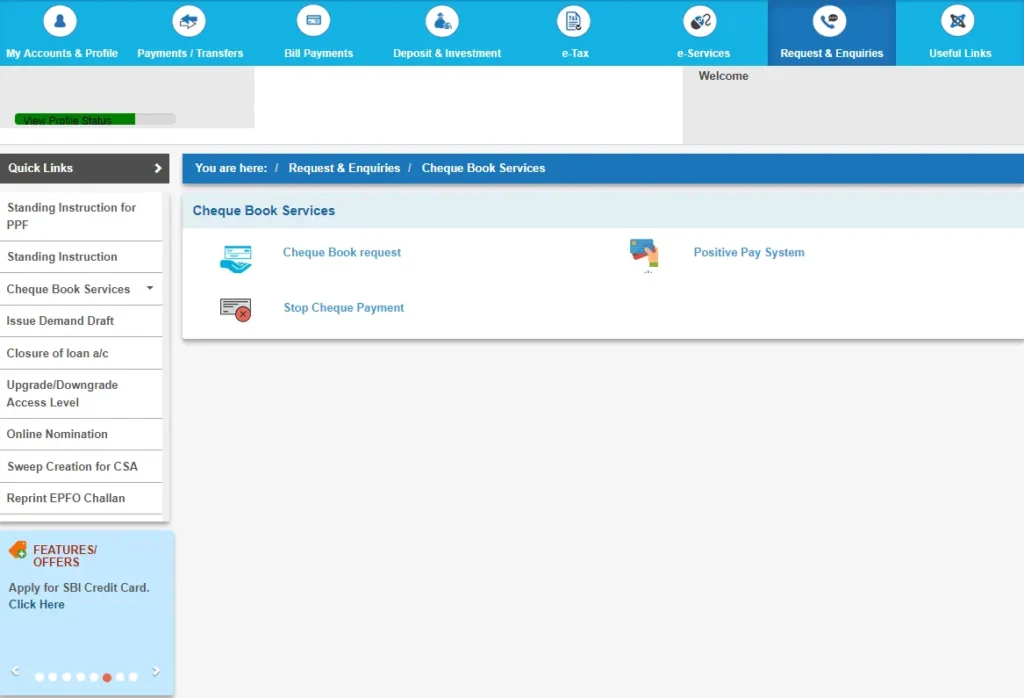

From the Request & Enquiries page, click on Cheque Book Services

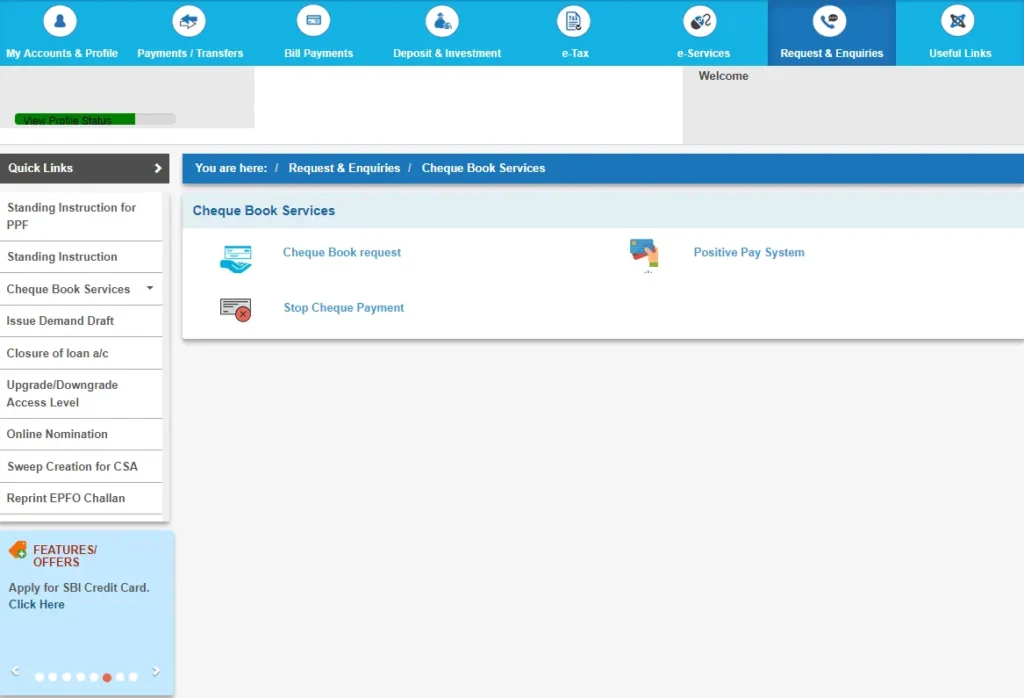

From Cheque Book Services page, Cheque Book request

On the next page, all your accounts will be displayed, just select the account for which you require a Cheque Book

At one time you can only issue one cheque book, so you won’t be able to choose the number of cheque books from the option available

Then choose the number of Cheque Leaves as per your need

From Instrument Sub Category Select you wish to order Bearer Cheque or Order Cheque

Please note that through online service you can request multi-city cheque book only, if you want a normal cheque book then you will have to go to your branch and request it

To proceed with the request click on the submit button

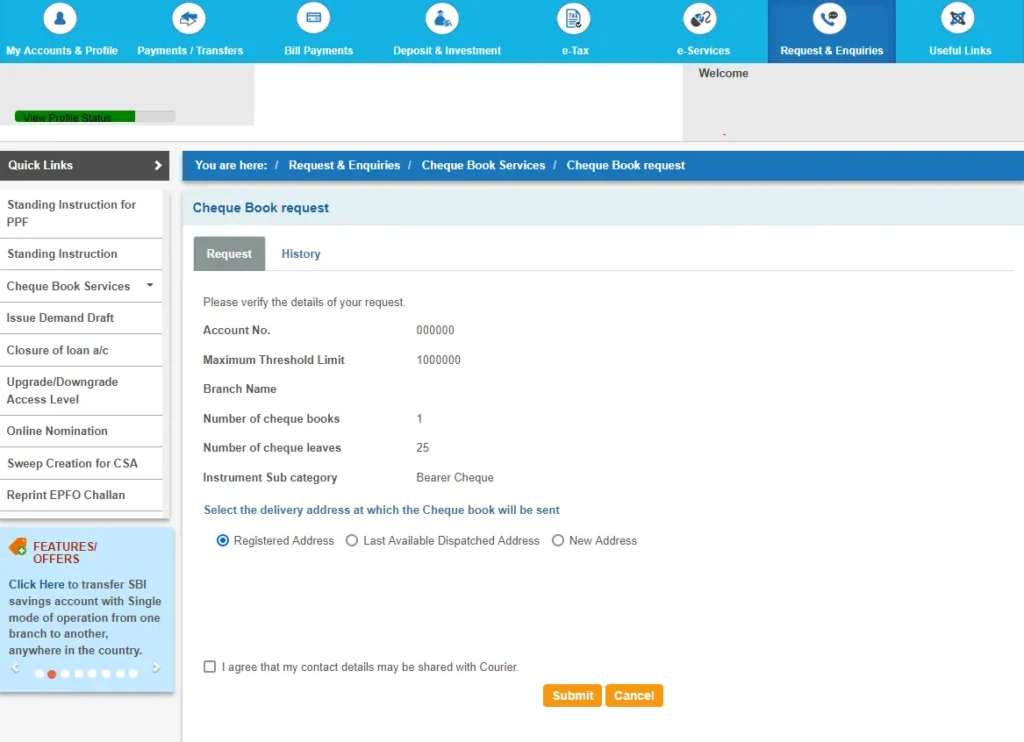

Once you had clicked on the submit button, you will be asked to verify the details of your request and you will also get an option to select the delivery address at which Cheque Book will be sent.

If you want the cheque book to be delivered on the address which is registered in the bank then you can select Registered Address option

OR

To get the cheque book delivered on the same address on which it was previously delivered, then select Last Available Dispatched Address option

OR

If you prefer the cheque book to be delivered to a new address then click on the new address option and then provide your new address

Once making the selection of delivery address, tick mark on I agree that my contact details may be shared with Courier and click on the submit button

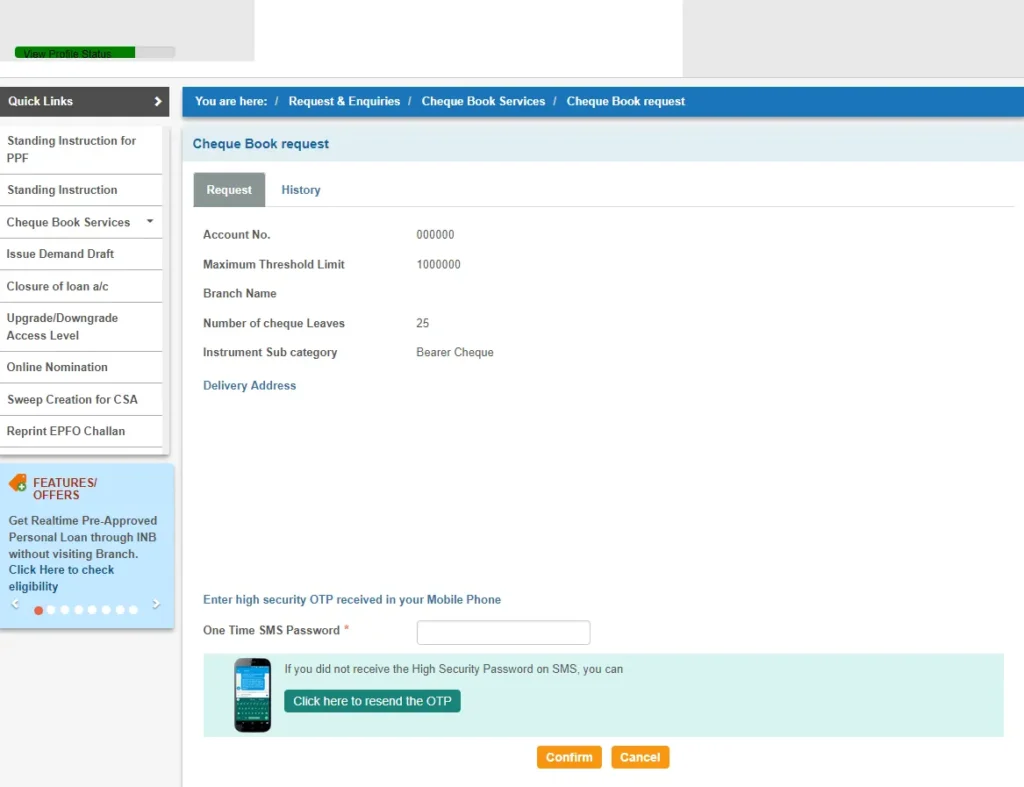

On the next page, you will get a chance to review your cheque book request details. Check the details and if everything is fine then enter the one-time-password that has been sent on your registered mobile number and click on the confirm button

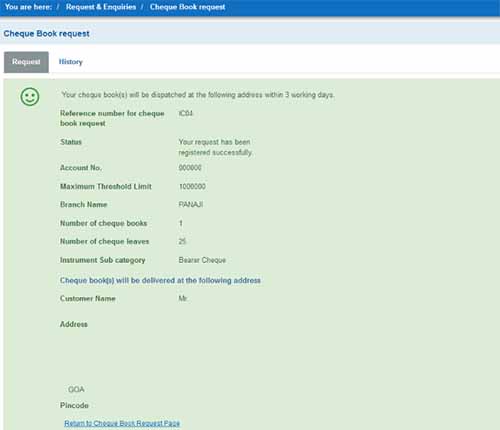

On the next page, a message will be displayed that the request for issue of cheque book has been accepted

Your order will be processed and the SBI Cheque Book will be dispatched to your address within three working days.

Once your cheque book has been dispatched you will receive an SMS on your registered mobile number with Speed Post Tracking Number so that you can keep track of your cheque book.

SBI Check Book Apply through SBI ATM

SBI Cheque Book can also be requested through SBI ATM without visiting the branch or filling in any transaction slips, to request one you should make sure that your updated or current address is registered with the bank as the cheque book will be delivered at the registered address. To order a cheque book through SBI ATM, follow the below steps:

- Walk into nearest SBI ATM with your ATM Card

- Insert the ATM card cum debit card into the ATM Machine

- Select Services > Request a cheque book

- Enter your ATM PIN

- And request the chequebook

Once the request has been placed, you will instantly receive a SMS on your registered mobile number and the cheque book will be dispatched at your registered address with bank in three working days.

Book State Bank of India Cheque through Twitter

State bank of India has launched a very unique feature for its SBI Customers which allows issuing a cheque book with social media banking. In order to raise the SBI Cheque Book request through twitter follow the below process.

To apply for cheque book, just DM SBI official Twitter profile with #SBICHQBook <Account No>

You will get a response to your request through DM, and the same will be dispatched in 3 working days on your registered address.

SBI Cheque Book Request through SMS

To request a cheque book through SMS medium you will need to compose SMS in the following format.

Send message “CHQREQ” to 09223588888

You will receive an SMS. Send consent SMS (CHQACCY6 digit no. received in SMS) to 09223588888 within 2 hours of receipt of SMS for further processing.

SBI Cheque Book Apply by visiting SBI Branch

If none of the above methods works to place the SBI Cheque Book Request, then you can request one through the branch.

Just walk into SBI Bank Branch, and request the SBI cheque book request form also known as application for cheque book sbi. You will get SBI Check Book Apply Form free of cost from the branch, or else you can even download the SBI Cheque Book Application Form in PDF from the below download button.

Fill-up the Cheque Request form (Cheque Book Request Letter) and submit it to the branch

Within 10 days you will receive the requested Cheque Book on your registered address as well as once the Cheque Book gets dispatched you will receive an SMS containing Speed Post Tracking Details of your SBI Cheque Book.

Order SBI Cheque book through YONO Portal

If you are holding Insta Savings Account then such account holders, as well as regular account holders can request cheque book’s through SBI YONO Portal.

To request cheque book’s through YONO by SBI Portal just visit official YONO Portal and log in using your username and the password

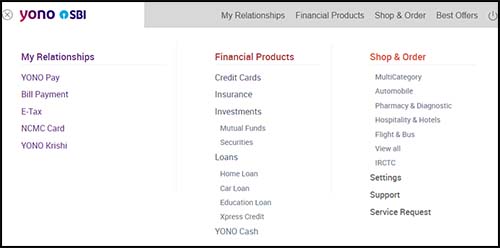

Once you are logged in to the portal, just click on the menu button

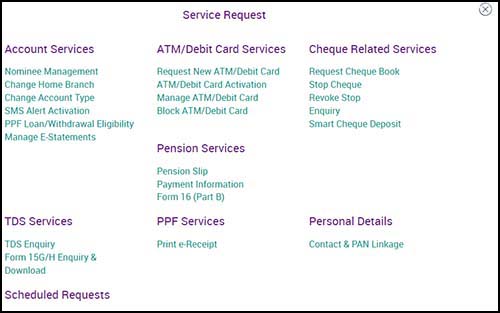

Under the menu, just click on the Service Request

On Service Request screen, just click on Request Cheque Book which is listed under Cheque Related Services

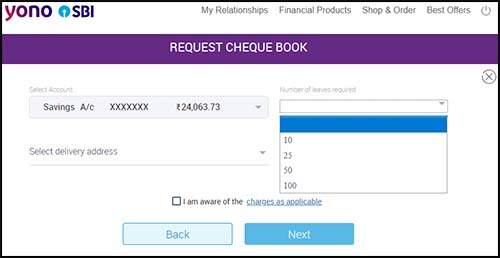

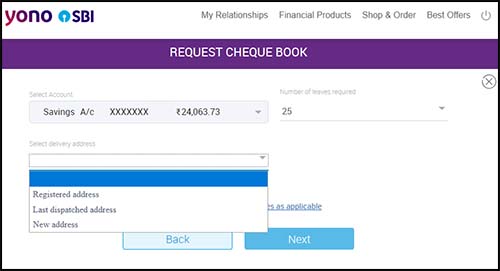

From the Request cheque book page, select your account for which you want cheque to be issued, select number of cheque book leaves, from the delivery address choose from registered address, last dispatched address or new address

Tick mark on I am aware of the charges as applicable and click on the Next button

One-Time-Password will be sent on your registered mobile number

Enter the received OTP code in the enter OTP field and click on the confirm button to confirm your request

On the next page, your cheque book request summary will be displayed

Now you have successfully done requesting a cheque book, your cheque book will be dispatched by the bank within 3 working days.

While requesting for cheque book online through Online SBI, ATM, Twitter or SMS, if you are getting an error “CHEQUE BOOK IS NOT AVAILABLE IN THIS ACCOUNT ” then you will need to get your account converted to Cheque book facility account. Below is the process which will help you to convert your non-cheque bank account to cheque book account.

Convert Ordinary S.B. Account to CHEQUE FACILITY A/C

Having an ordinary account without a cheque book facility won’t allow you to enjoy the online facility to request a cheque book. So to enable cheque book facility with your account you will need to convert your account to CHEQUE FACILITY A/C by submitting an application for non cheque account to cheque account in SBI Branch.

To submit a request to the branch to convert your S.B. Account to CHEQUE FACILITY A/C, you will have to request for the form from the branch free of cost or else you can download the form from the below download button.

Fill up the form enclose a required photocopy of your documents, three recent passport size photographs and submit it to the branch

Your request will be processed by the bank and your account will be converted into Cheque facility account.

And once your account gets converted, you will be able to request cheque book online without any errors.

Remember that once converting the account, you will need to maintain a minimum balance as prescribed by the bank.

If your bank branch is very far away or if you don’t have time visiting the branch to convert your ordinary account to a cheque facility account, then you can also place a request online to convert your Non-Cheque Book account into cheque facility account. Below are the steps mentioned to Change SBI Normal Account to Cheque Book Account.

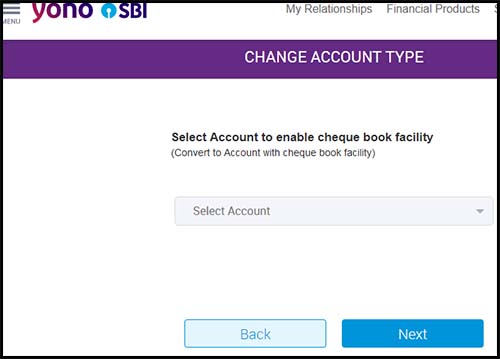

Change SBI Normal Account to Cheque Book Account through YONO

To convert your Non-Cheque Book account into cheque facility account visit SBI Yono website or install SBI Yono app on your phone

Login into the portal or app using your internet banking username and password

Go to Menu > Service Request

Under Account services select Change Account Type

Select your account from the list to enable cheque book facility and click or tap on the Next button

On the next page, you will be asked to enter the one-time-password sent on your registered mobile number to confirm the request

Enter the received OTP and click on the submit button

Your account will get upgraded to SBI Cheque Book Account and now you will be able to request cheque book online.

How to Track Cheque Book Status in SBI

Your cheque book will be dispatched by India Post within 3 working days after placing the request. In between till your SBI Cheque book gets delivered to you, you can keep an eye on the status of your SBI Cheque book request through the SBI Portal.

To track SBI Cheque book dispatch details, you need to login to Online SBI Portal

Click on More>> under Request & Enquiries tab

From the Request & Enquiries page, click on Cheque Book Services

From the Cheque Book Services page, click on Cheque Book Request

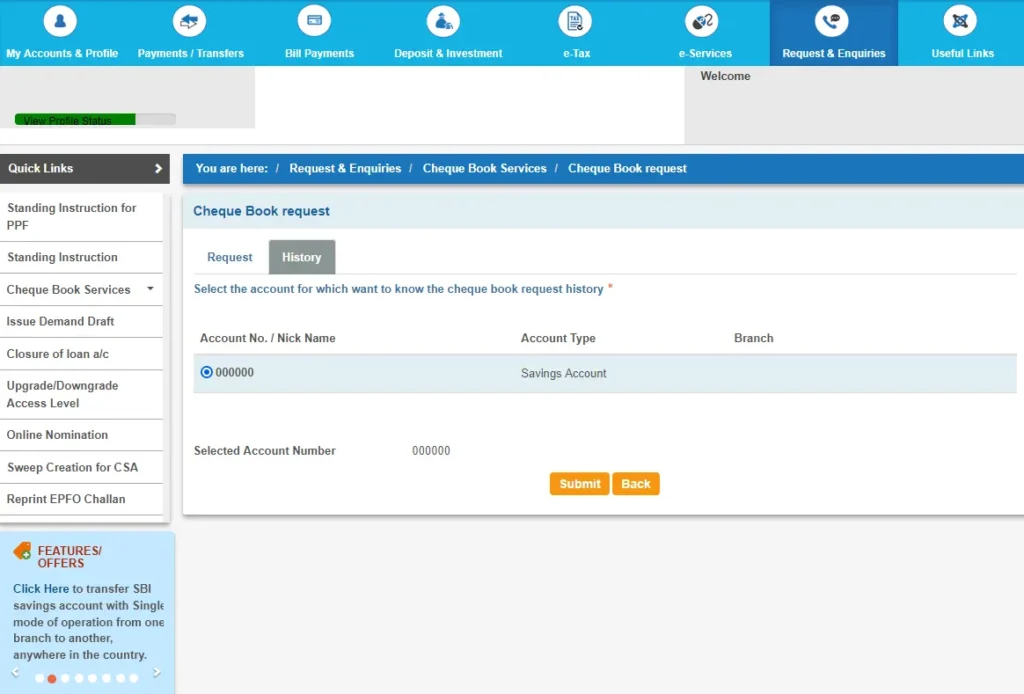

From the Cheque Book request page click on History tab

Select the account for which want to know the cheque book request history and click on the submit button

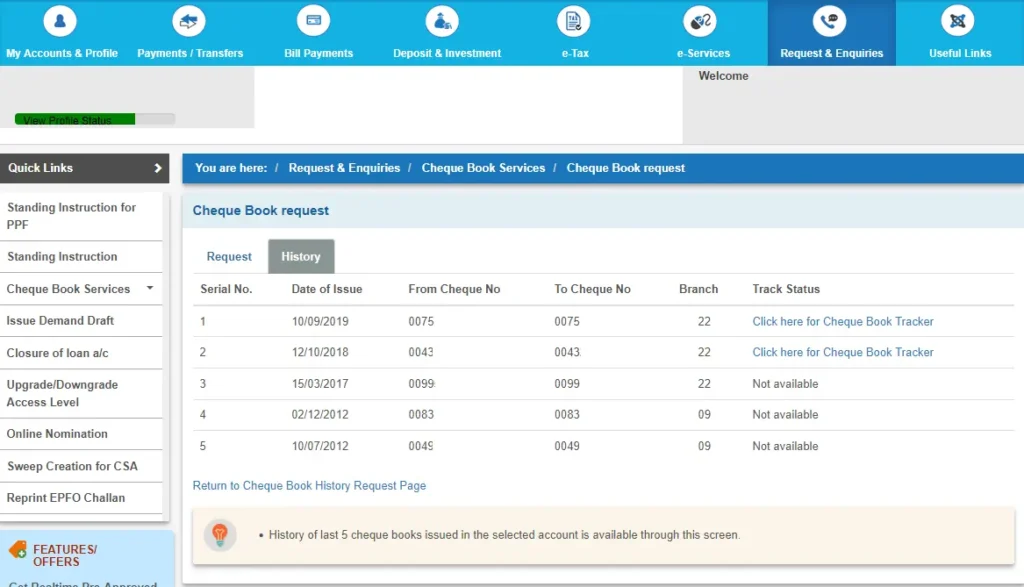

On the next page, a complete history of requested cheque book will be displayed with details like Date of Issue, From Cheque No – To Cheque No, Branch and Track Status

To track the status, just click on the “Click here for Cheque Book Tracker” which is under Track Status section

This will display the dispatch details of your cheque book

SBI Cheque Book Charges

| Savings Bank accounts having Quarterly Average Balance (QAB) as on previous quarter end below ₹25000 | ₹3 per cheque leaf |

| Accounts having QAB ₹25000 and above as on the previous quarter-end | ₹2 per cheque leaf |

| Senior citizen/salary accounts | 50 Leaves free per year |

| Other P-Segment/AGL Segment customers | 20 leaves free per year |

| Emergency Cheque book (10 leaves set) Current & Savings Bank account | ₹50 +GST |

| Emergency Cheque book Senior Citizen (Irrespective of QAB) | Free |

If you are not getting new address option while requesting the cheque book then visit your home branch and update KYC and address.

The change in your account variant type from non cheque to cheque book account should be done on the same day on complete submission of the required documents.

Yes, you can request for emergency cheque book of SBI by visiting the home branch. An emergency cheque book will be instantly issued to you on the spot, but it would be a non-personalized cheque book.

To get cheque book from SBI immediately you can walk in to the branch and request for instant cheque book.

If you are getting such error than you should try requesting the cheque book later on after few hours or few days.

Hi,

My father is staying with me in Bangalore, but his branch is in Kolkata. He has run out off cheque books and needs them immediately. Can we file a request for cheque book at any branch and request to deliver at my present address(not the registered address)?

Hello Arnab,

If you Request Cheque Book Online through SBI Net Banking you can enter new delivery address.

Regards

Hello Sir,

Am staying in Mumbai and I don’t have internet banking. How can I apply for a check book? Is there any option through email ??

Hello Banesh Kumar Rana,

There is no facility in SBI to request cheque book via mail but you can request a cheque book by visiting your branch.

Hi may i know the eligibility of applying Cheque Book?

Hello Prashanth,

There is no eligibility criteria as such to apply for SBI Cheque Book, You can request for a Cheque Book for any of your accounts (Savings, Current, Cash Credit, Over Draft).

Charges @ Rs.3/- per cheque leaf for all Savings Bank accounts having Quarterly Average Balance (QAB) as on previous quarter end below Rs.25,000/-. First 20 leaves free.

Charges @ Rs 2/- per cheque leaf for accounts having QAB 25000/- and above as on previous quarter end. First 50 leaves free.

Hi.. I stay in Bangalore.. when i tried to apply cheque leaves online through mu account it shows this statement.. ‘cheque book not available on this account’… Why it shows like that? How to get it online?

Hello Dharani,

If you are facing such problem, than you will have to apply for cheque book by visiting the branch and from next time on-wards you will be able to apply for cheque book online.

Hello sir.. thanks for your reply.. i visited branch and applied for cheque book.. they told it ll take 10 days to get it in hand.. is there any option to track the status?

Hello Dharani,

Once your Cheque Book gets dispatched you will receive tracking details through SMS on your registered mobile number. But in case if you don’t receive your tracking details just get connected to SBI Customer Care Toll Free Number 1800 425 3800.

Hi

I applied checkbook from ATM last mnth bt 12days completed bt I didn’t get any msg frm bank… plz help me what can do I’m…

Hii

I have account in sbbj bikaner branch and am trying to request chequebook through netbanking but it is telling “CHEQUE BOOK NOT AVAILABLE ON THIS ACCOUNT.”

please tell me how to apply for chequebook now?

Hello Aditya,

Once you will have to apply for Cheque Book by visting branch, and from next time onwards whenever you need cheque book you can order it online.

Dear Sir,

I want to new cheque book. My account No 11057026828. Kindly issue to new cheque book 25 leaves please.

Thanks & Regards

C ANANDAN

CELL : 99940 38232

i want to new chekbuk esu plg vry agrent…..

I need a cheque book containing 25 pages against my sbi account no 102XXXXXXX5

I have to require cheque book ,I want to make a request by SMS

Thanks

Vinod

Hii

I have account in sbi branch and am trying to request chequebook through net-banking but it is telling “CHEQUE BOOK NOT AVAILABLE ON THIS ACCOUNT.”

please tell me how to apply for cheque book now?

I have the same problem.

Sir

My father applied cheque book and had a message but he deleted sms (dispatched) but post office person asking dispatched no and bank person ask dispatched no but how he get.

मैने तीन बार चेक बुक के लिए आवेदन दिया है पर अभी तक चेक बुक नही आई क्या करू

आपके मोबाइल नंबर पे कन्साइनमेंट नंबर एसएमएस आया होगा, वह आप देख लीजिए और ट्रॅक कर लीजिए|

Sir, I was applying through SBI net banking. But when I clicked SUBMIT button it showed.. CHEQUE BOOK NOT AVAILABLE ON THIS ACCOUNT.

please help me.

Hello Amarjit,

If your account has been not ever issued Cheque Book than you can’t request online, first you will have to submit cheque request by visiting branch and from next time you can request online.

I want sbi cheque book through sms reply how to send message on which number

Hi. Can I apply to any other city branch or is it compulsory to go to home branch?

My Sisters is having account with Shahpura Jaipur but she stays with me in Ghaziabad. She is not having ATM nor Internet banking and she is unable to visit home branch how cheque book can be received here in Ghaziabad.

Hello Umesh,

If she doesn’t hold ATM Card or Net Banking there is no other option available for her to request cheque book from Ghaziabad. But you can still try visiting any SBI Branch in Ghaziabad and try to request a cheque book, may be after hearing your problem they might issue you a cheque book.

When I make a request i received that check book is not available for your account, do pls tell me what should I do??

This is my one time for applying check book. From which branch I have to request check book. Whether my home branch or the branch near to my office??

what is minimum amount required in our account for applying cheque book.? is there any such criteria..plz reply mi