Recently, the Reserve Bank of India (RBI), the organization overseeing India’s banking system, directed Paytm Payments Bank (PPBL) to make some changes. Here’s a breakdown of what this means for Paytm users.

The RBI has asked PPBL to stop adding new customers, and existing Paytm Bank customers can continue using the service until February 29, 2024. After this date, PPBL won’t be able to accept any more deposits, process credit transactions, or facilitate top-ups in various customer accounts, including prepaid instruments, wallets, FASTags, and NCMC Cards.

It’s important to note that this directive doesn’t affect the money already in customers’ accounts. So, even after February 29, customers can still withdraw money from their existing balance.

Below is the email sent by the Paytm to its Paytm Payments Bank Account/Wallet Customers

Dear Customer,

The Reserve Bank of India (RBI) has issued a directive restricting Paytm Payments Bank Account/Wallet from accepting new deposits or allowing credit transactions after February 29, 2024.

Please note that you will not be able to deposit or add money to your Paytm Payments Bank Account/Wallet after Feb 29, 2024. However, there is no restriction on withdrawal of money from your existing balance even after Feb 29, 2024.

The directive does not impact your existing balances and your money is safe with the Bank.

This update has led to many questions from Paytm Payment Bank Savings Account holders, Paytm FASTag users, Paytm Payments Bank FD customers, Paytm Payment Bank Gateway users, and Paytm Business users. In this article, we’ll address and clarify the concerns related to these changes brought about by the RBI directive.

Table of Contents

Paytm Payments Bank

As of February 29th, 2024, the Reserve Bank of India (RBI) has issued a directive that restricts Paytm Payments Bank Account from accepting new deposits or facilitating credit transactions. It is important to note that any attempts to deposit or add funds to your Paytm Payments Bank Account after this date will not be possible. However, there is no impediment to the withdrawal of funds from your existing balance even after February 29th, 2024. Importantly, this directive has no bearing on existing balances, assuring the safety of your funds with the Bank.

Paytm Recharge & Bill Payments

The functionality of the Paytm App remains unaffected, allowing you to seamlessly continue making bill payments and recharges, just as you have always done.

Paytm Wallet

You can continue availing yourself of Paytm Payments Bank Wallet services. It is important to be aware that any attempts to add funds to your Paytm Payments Bank Wallet after February 29th, 2024, will not be feasible. Nevertheless, there are no limitations on utilizing the existing balance in your wallet even after February 29th, 2024.

Paytm for Business Payment Gateway

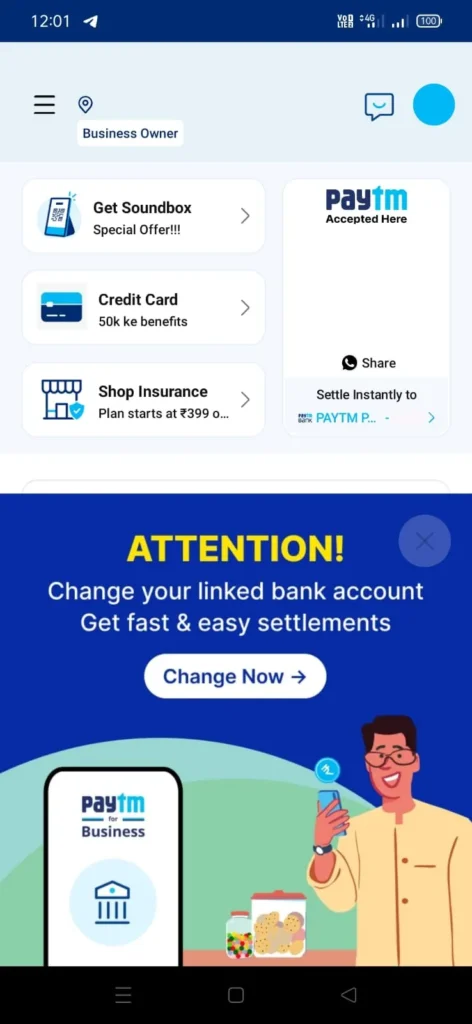

Despite the recent ban by RBI on Paytm Payments Bank, Paytm Business services will continue without any interruptions. This includes popular offerings like Paytm QR, Paytm Sound-box, and Paytm Card Machine. Paytm plans to ensure the smooth functioning of these services by expanding partnerships with third-party banks to facilitate payments and financial services.

To continue receiving payments through Paytm QR, Sound-box, or Card Machine, customers using Paytm Payments Bank LTD for settlements need to take a simple precaution. They should add a new bank account to their Paytm Business account. This ensures a hassle-free experience for merchants relying on Paytm for their business transactions. Paytm can also bring new offline merchants on board.

Paytm Business app is prompting its users in app by displaying banner and through email to Change Settlement if their Settlement account is Paytm Bank.

We Value Our Partnership! 🙏

Thank you for being a valuable partner.

To ensure faster and safer settlements, please change your linked bank account on the Paytm for Business app.

Don’t worry, your money is safe with us! Continue to enjoy safe, secure & lightening fast payments on Paytm QR

Paytm FASTag

The customer can continue using the Paytm FASTag existing balance. Paytm FASTag will continue to work even after the Feb 29th, as it will make partnership with third party banks to provide the services.

Other Services by Paytm

All additional services available on the Paytm App, including but not limited to movie ticket bookings and financial services, remain unaffected. You can continue utilizing these services on Paytm seamlessly, both now and beyond February 29th, 2024.

Paytm Gold

Paytm Gold Investments offer a high level of security, backed by MMTC-PAMP. Users can confidently engage in buying or selling digital gold through the app without any worries. Importantly, it’s worth noting that the recent directives from RBI on Paytm Payment Bank do not affect Paytm Gold Investments.

Paytm Money

Fear not, your investments with Paytm Money are as sturdy as a fortress. The recent RBI guidelines on their associate bank won’t cause a ripple in Paytm Money’s operations or your investments in stocks, mutual funds, or NPS. Paytm Money Limited, under the watchful eye of SEBI, maintains unwavering compliance to ensure your financial peace of mind.

Paytm NCMC Card

Feel free to keep using the money on your Paytm NCMC Card. Paytm has been teaming up with more banks lately, and they’re speeding up this process. They’re actively working on making things smooth for you and will keep you in the loop with updates.

Will Paytm app Stop Working After 29th Feb 2024

Vijay Shekhar Sharma, the founder of Paytm has officially tweeted on X, stating

To every Paytmer,

Your favourite app is working, will keep working beyond 29 February as usual.

I with every Paytm team member salute you for your relentless support. For every challenge, there is a solution and we are sincerely committed to serve our nation in full compliance. India will keep winning global accolades in payment innovation and inclusion in financial services – with PaytmKaro as the biggest champion of it.

The RBI (Reserve Bank of India) has said that after Feb 29, 2024, you can’t add more money to your Paytm Payments Bank Account or Wallet. No new deposits or adding money will be allowed.

But don’t worry, if you already have money in there, you can still take it out even after Feb 29, 2024. The directive doesn’t mess with the money you already have in your Account or Wallet. Your money is safe with the Bank.

Paytm Payments Bank is actively working to comply with RBI’s instructions. They’re exploring options to minimize the impact on users’ financial transactions and operations. Regular updates will be provided.

Rest assured, banking services will continue without interruption until Feb 29, 2024.

Paytm Payments Bank is doing what it takes to follow RBI’s guidelines. They’re figuring out options to minimize the impact on users’ money matters and will keep everyone updated regularly.

Rest assured, the banking services will stay on track until Feb 29, 2024.

Following the RBI directive, after Feb 29, 2024, DBT won’t be credited to Paytm Payments Bank Accounts. Paytm recommend’s switching your DBT to a different bank account.

The NACH mandate will continue to be executed post-Feb 29 as long as there is a balance in your Paytm Payments Bank account. However, in accordance with the RBI directive, depositing or adding money to your Paytm Payments Bank Account/Wallet will not be possible after Feb 29, 2024. Therefore, Paytm has requested the customers to transfer your NACH mandate to an alternate bank account.

Following the RBI directive, you won’t be able to add money to your Paytm Payments Bank Savings/Current account/Debit Card/NCMC/Transit/FASTag after Feb 29, 2024. However, you can still withdraw money from your existing balance even after that date.

The directive doesn’t affect the money you already have in your Account or Wallet; it’s safe with the Bank. For more help, visit the Help and Support section on our App.

In accordance with the RBI directive, depositing or adding money to your Paytm Payments Bank wallet won’t be possible after Feb 29, 2024. However, there’s no restriction on withdrawing money from your existing balance even after this date.

The directive does not impact the existing balances in your Account or Wallet, ensuring the safety of your funds with the Bank.

The existing balances in your Paytm Payments Bank Account or Wallet remain unaffected by the RBI directive. If your account is unblocked after Feb 29, 2024, you will have full access to utilize the balance for payments or withdrawals without any restrictions.

Following the RBI directive, no new Fixed Deposits can be booked after Feb 29, 2024. However, the redemption of your existing Fixed Deposits remains accessible at any time, even after this date. These Fixed Deposits are secure and operational as they are managed by their Partner Bank, IndusInd Bank Limited.

In accordance with the RBI directive, adding or depositing money into your Paytm Payments Bank Wallet won’t be possible after Feb 29, 2024. Nevertheless, there is no restriction on withdrawing money from your existing balance even after this date.

Rest assured, the directive does not affect your existing balances, ensuring the safety of your funds with the Bank.

The process for closing your wallet/sub-wallet remains unchanged, and you can transfer any remaining balance in your PPBL Wallet to your bank account using the existing process of the bank.

Leave a Reply