The Savings Max account offered by HDFC Bank is a premium account that offers a range of advantages to its holders. Alongside these benefits, the Savings Max Account is subject to specific conditions that account holders must meet to sustain this account type.

Anyone can open the Savings Max account online or by directly visiting the branch. And in case if you are an existing HDFC Bank Customer holding a regular type of Savings Account or any type of Savings Account, then HDFC Bank also offers you an option to upgrade to Savings Max without closing your existing one or without opening a new one.

Before we begin with the upgrading process, let’s get familiar with the benefits and eligibility of the HDFC Bank Savings Max Account.

Table of Contents

Benefits of HDFC Bank Savings Max Account

| Free lifetime Platinum Debit Card for the primary account holder with a daily cash withdrawal limit of ₹1,00,000 and shopping limit of ₹5,00,000 | Unlimited ATM Transactions (HDFC and Non-HDFC bank ATMs with the Platinum Debit Card) |

| Free Insta Alerts | UPI, NEFT & RTGS transactions without any charges |

| Free Demand Drafts at HDFC Bank locations, up to ₹1 lakh per day | Personal Banker |

| Zero Liability Cover, Insurance on Loss of checked-in baggage | Earn higher interest with the MoneyMaximizer feature on idle money in your account by requesting for automatic sweep out facility where surplus funds are automatically put in a fixed deposit |

| If at any time your savings account starts to run low on funds, the Fixed Deposit will be automatically dissolved to meet the shortfall with Sweep-In facility |

Eligibility for Savings Max Account

| Resident Individuals (sole or joint account) | Hindu Undivided Families |

| Foreign Nationals Residing in India* | Minor above the age of 10 years are eligible to open self-operated minor account and an ATM/Debit card can be issued to the Minor |

Minimum Balance requirements for Savings Max

| The Average Monthly Balance (AMB) in the SavingsMax Account should be > or = ₹25,000 or maintain requisite FD Relationship as per branch location |

Upgrade HDFC Savings Account to Savings Max

You can upgrade to Savings Max Account from any type of Savings Account, but to upgrade you need to fulfill the main criteria which is the minimum balance requirement. And if you fulfill that main requirement then you can get your Savings Account converted to Savings Max.

To convert your HDFC Savings Account into Savings Max, you need to compulsorily visit the branch. As there isn’t any option available in HDFC Bank NetBanking or Mobile Banking app which offers to raise an upgrade request online.

But before you visit the branch, you need to carry the following documents with you:

| Identity Proof Document | Proof of Address Document |

| PAN Card | and your bank account number |

Upon visiting the branch, kindly inform the staff that you wish to initiate the process to upgrade or convert your current Savings account into a Savings Max Account.

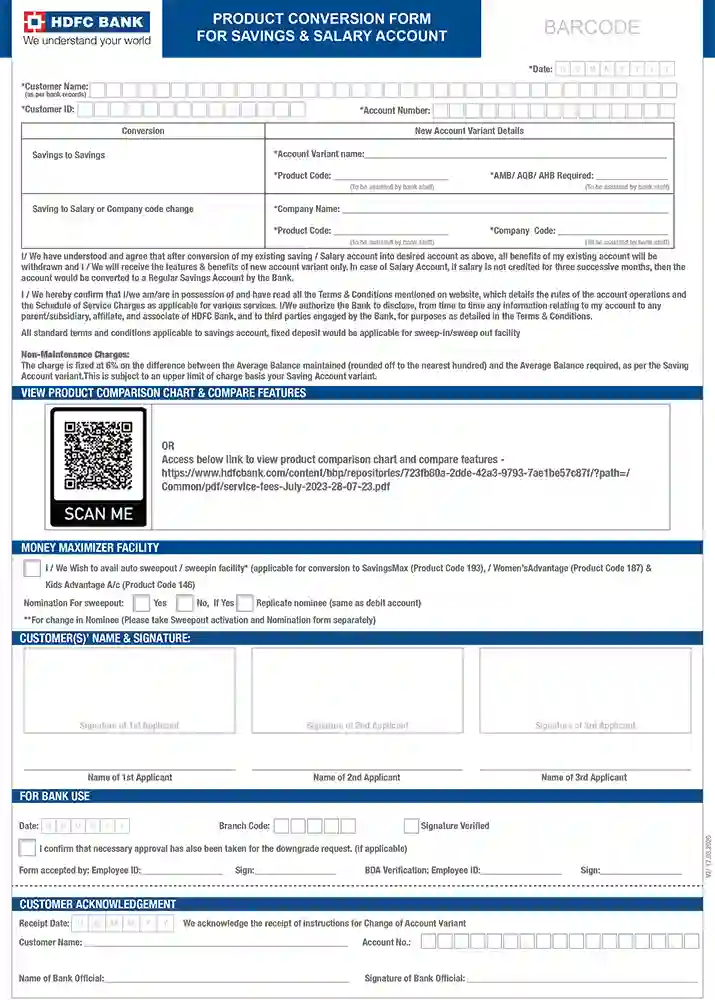

The staff will provide you with an HDFC Savings Max Upgrade form that requires thorough completion. Should you encounter any challenges in filling out the form, feel free to request assistance from the staff, who can assist in completing it on your behalf.

You will be inquired about your preference for maintaining the Savings Max based on either Savings Balance or Fixed Deposit.

Opting for the Savings balance option requires maintaining a balance of ₹25,000 consistently in your Savings Account, without any shortfall. Alternatively, should you choose the Fixed Deposit option, it is imperative to uphold the specified Fixed Deposit amount as communicated by your respective branch.

If you currently hold a fixed deposit with HDFC Bank that aligns with the stipulated requirements, you may formally request the bank to facilitate an upgrade based on your existing fixed deposit.

If you do not currently possess a fixed deposit, you have the option to open one explicitly to meet the specified requirement or maintain a balance of ₹25,000 in your Savings Account. I would recommend considering the option of upgrading to Savings Max based on a Fixed Deposit, as it offers a more favorable interest rate compared to maintaining ₹25,000 in a regular savings account.

Upon selecting the balance requirement criteria, you will be requested to sign on the form. Prior to signing, it is advisable to thoroughly verify the form to ensure accurate and complete information.

Along with the form, you need to enclose identity proof, proof of address and PAN copy

Upon the submission of these documents alongside the completed form, the process of requesting the account upgrade is considered successfully concluded.

The bank will process your request within a timeframe of three working days.

The bank personnel will inform you that upon the successful upgrade of your account, you will receive notifications via SMS and email. However, in my experience, I did not receive such messages in either SMS or email format.

If you wish to confirm or validate whether your account has been upgraded to Savings Max, you can utilize the following procedure.

Verify if the account is upgraded to Savings Max Account

If you are interested in ascertaining whether your Savings account has been successfully converted into a Savings Max account, there are three methods available to verify this information.

Call HDFC Bank Customer Care and ask them to check your account type, if they say your account is Savings Max then your account has been upgraded successfully.

OR

Visit the branch and inquire about your Savings Max Upgrade request

OR

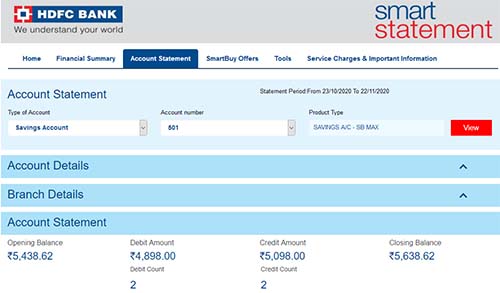

Open your monthly account statement email (check the latest statement which was sent to you after placing an upgrade request)

Click on the View your SmartStatement

Enter your password to view your statement which will be your customer id and click on the OK button

Click on the Account Statement tab

On the Account Statement page, under product type, if you can see Savings A/C – SB MAX then it means your account has been upgraded to Savings Max

Upgrade Debit Card to EasyShop Platinum

As you are aware that with the HDFC Savings Max account you get a free lifetime EasyShop Platinum Debit Card. So if you have opened a new Savings Max account then in that case you will automatically get the EasyShop Platinum Debit Card. But in case if you have upgraded your existing Savings to Savings Max then you won’t be getting the EasyShop Platinum Card automatically.

Once your HDFC account gets upgraded to Savings Max account, you need to manually place an upgrade request for EasyShop Platinum Debit Card which can be done through NetBanking or by visiting the branch.

Even after your account gets upgraded to Savings Max if you don’t upgrade your Debit Card to EasyShop Platinum and you use your existing variant of debit card which you were holding previously then you will be charged an annual charge as per the card type which you are holding. So to enjoy the free debit card benefits of Savings Max you need to upgrade your existing card to EasyShop Platinum Debit Card.

Before upgrading your Debit Card, make sure that your account has been converted to Savings Max, or else you will be charged an annual fee for the card as per the applicable rate.

Conclusion: The HDFC Savings Max account stands as a highly advantageous option for individuals seeking a debit card without an annual fee, unrestricted ATM transactions at both HDFC and non-HDFC ATMs, complimentary SMS alerts, and numerous other benefits. Notably, the distinctive feature of Savings Max allows account maintenance based on a Fixed Deposit, eliminating the need to uphold an Average Monthly Balance (AMB) above ₹25,000. For those with a qualifying fixed deposit in HDFC Bank, upgrading to Savings Max is strongly recommended to avail of the diverse benefits offered by this account.

No, you cannot upgrade your HDFC account to SavingsMax account online. To upgrade you need to visit the branch. However if you want to open new SavingsMax account then you can open it online.

Yes, if you want to downgrade from SavingsMax to any type of Savings account then you can do it anytime. To downgrade you need to visit the HDFC branch, fill the savings max downgrade form enclosed the document and submit it.

If you don’t maintain the balance or FD as per the requirement of SavingsMax account type then your account won’t be downgraded. However Service/Transaction charges will be applied in the current month based on the AMB maintained in the account in the previous month.

The above Product Conversion From for Savings & Salary Account can also be used as hdfc bank account downgrade form.

Hey can i downgrade the account also? i mean back to Regular savings account ? any time frame to downgrade?

Hello Kathir,

You can downgrade to regular savings account anytime from the time of the upgrade.

To downgrade you need to visit the branch with your documents and place a request.

They dont have any process to downgrade account.

I am trying to downgrade my saving max account for last one year and till now they have not done it.

Came to know that they need zonal head approval for downgrading single account.

Looks like just a lame excuse to delay process.

Totally useless bank.