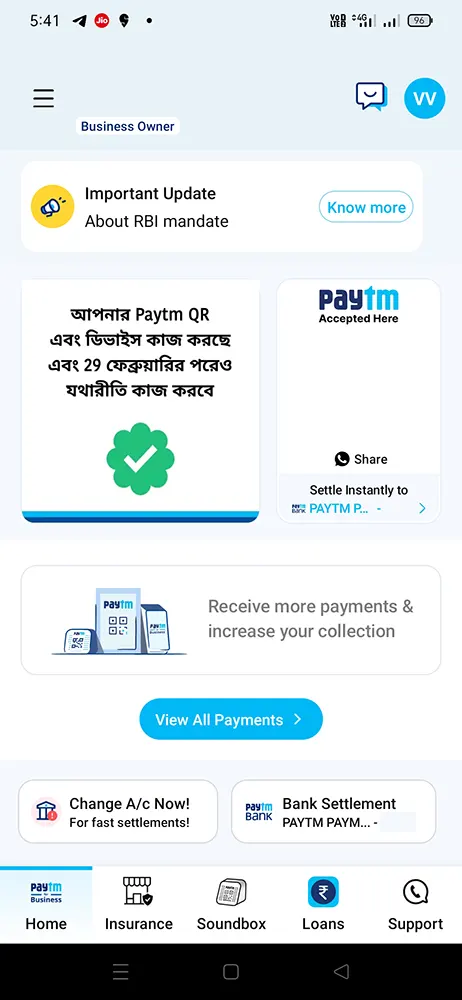

Change Paytm Business Bank Account: If you’re using Paytm for Business to accept payments through various channels like Paytm QR, Sound Box, UPI, and Debit/Credit Cards, and you’ve linked your Paytm Payments Bank Account to receive settlements, there’s an important update you need to know. The Reserve Bank of India (RBI) has mandated that Paytm Payments Bank will no longer be allowed to operate after February 29th, 2024.

This means if you continue relying on your Paytm Payments Bank Account for settlements, you won’t be able to receive payments accepted through Paytm for Business after this date. To ensure you can keep receiving these payments seamlessly beyond February 29th, 2024, Paytm is advising users to change their settlement bank account.

In simpler terms, if you want to keep getting paid through Paytm for Business after February 29th, 2024, you’ll need to switch to a different bank account for settlements. This way, you can avoid any disruptions to your business transactions and continue operating smoothly.

It’s important to heed this recommendation from Paytm to avoid any inconvenience and to ensure your business can continue accepting payments without interruption. So, if you haven’t already, make sure to update your settlement bank account before the deadline.

Paytm has sent a email to it’s Paytm Business Customers regarding the latest update stating “We are reaching out to assure you that your Paytm QR, Soundbox & card machine will keep working after the 15th of March as well. This has been unambiguously cleared by the RBI in its guidelines dated 16th February“

Changing your settlement bank account in Paytm for Business is a breeze with its app. Here’s how you can do it:

Change Paytm Business Bank Account Online

To Change Paytm Business Bank Account Online open the Paytm for Business app

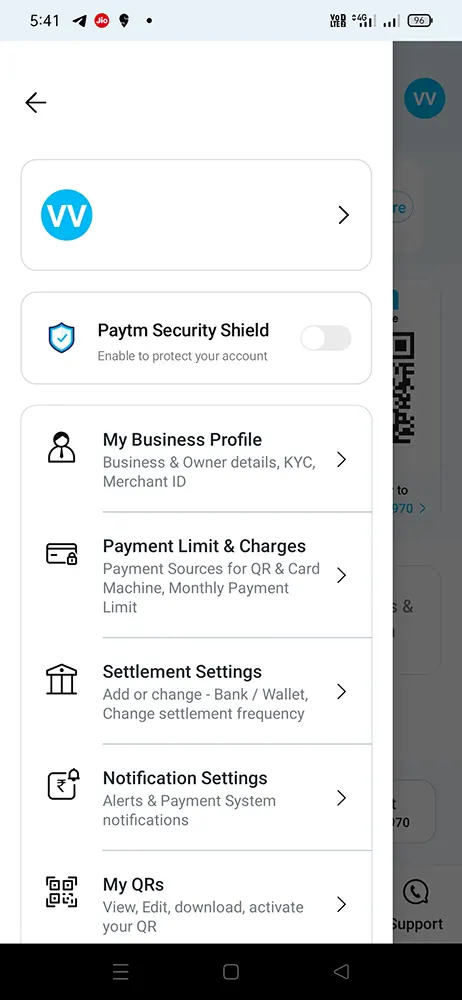

Tap on the Hamburger icon appearing at top left corner

From the options presented, tap on Settlement Settings

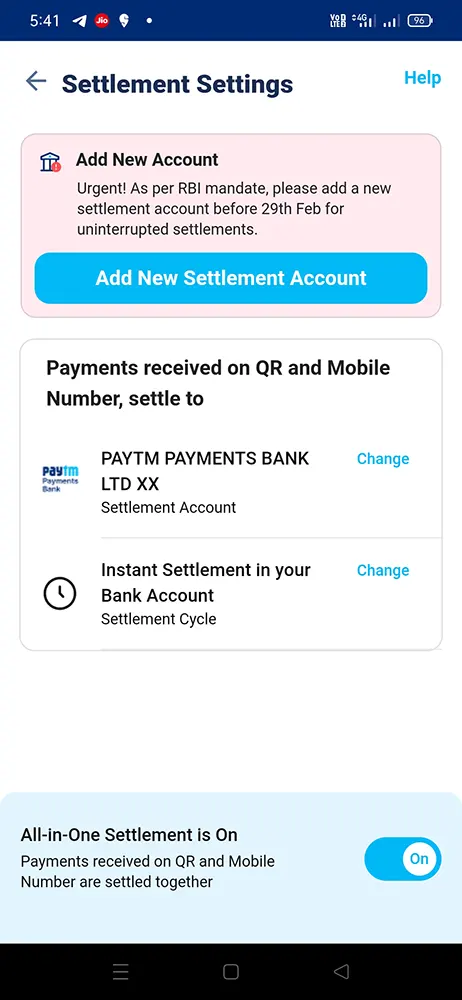

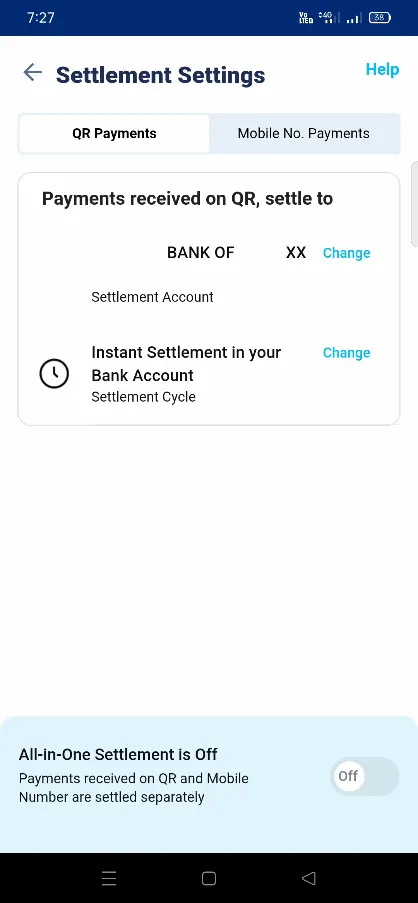

On the Settlement Settings page, the current bank which is added as Settlement Bank will be displayed

To change Settlement bank account tap on the Change button appearing against the already added bank account

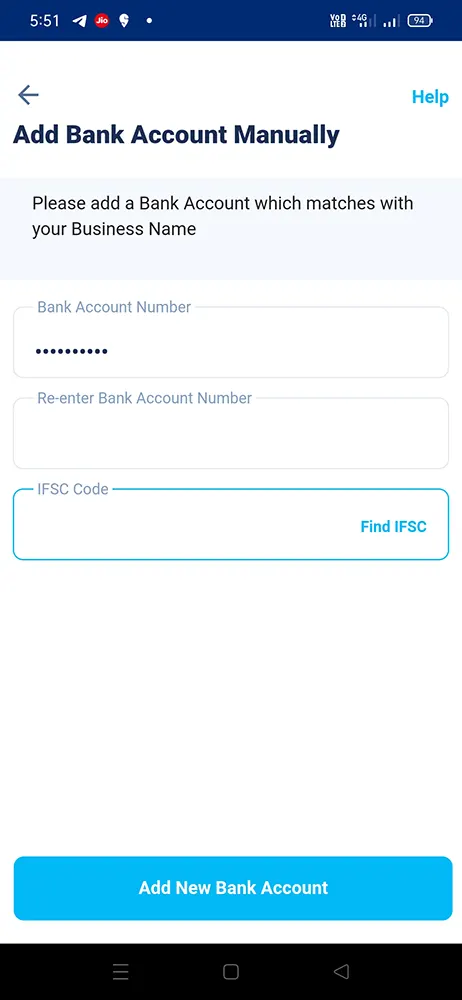

On the next page, fill in the bank account number, reconfirm the bank account number and IFSC Code

Once adding these details, tap on the Add new Bank Account

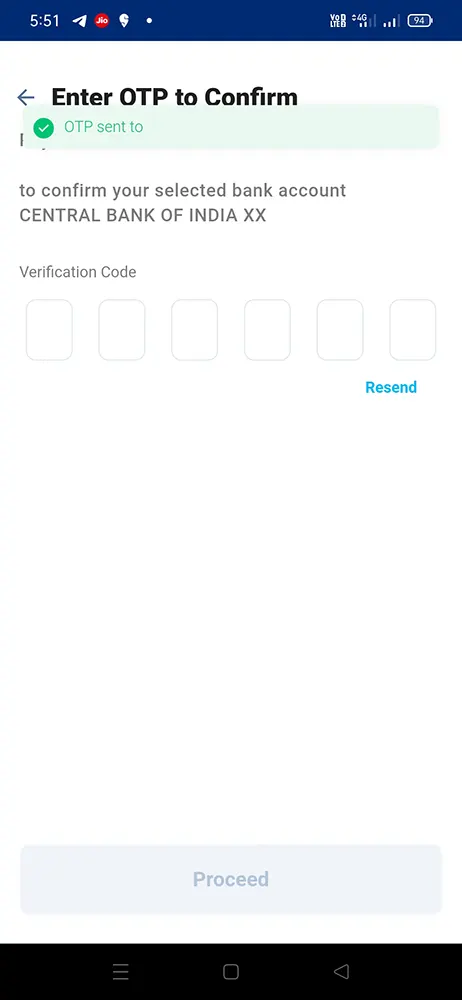

A one-time-password/ security code will be sent on your registered email address as well as mobile number

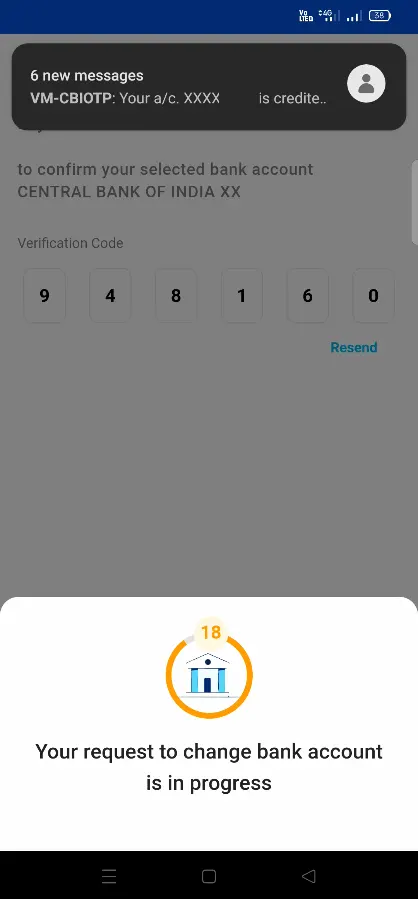

Enter the received security code and tap on the Proceed button

Your new bank account is now successfully added as the settlement account. For verification Paytm will credit ₹1 in your added bank account

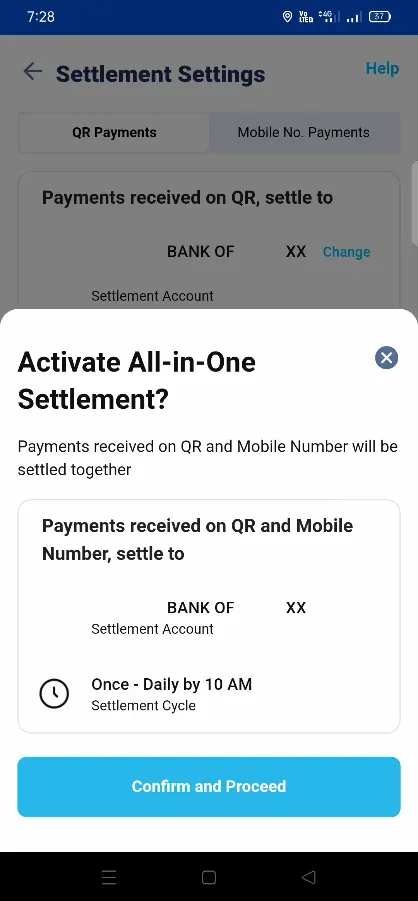

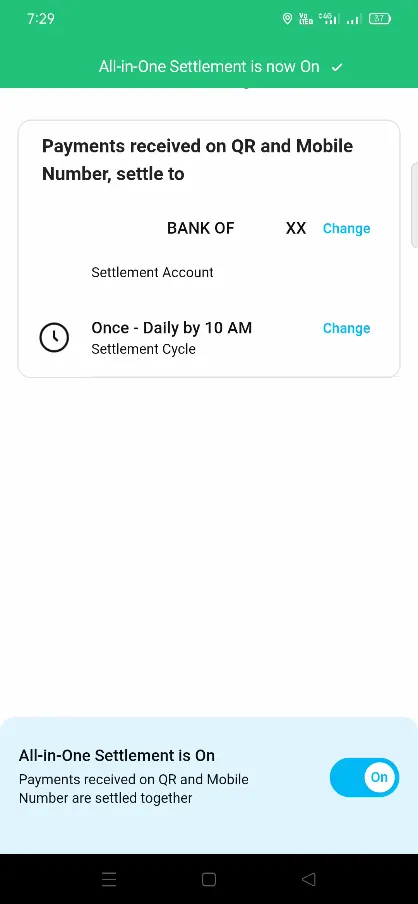

Payments received on QR will be settled on this new account which you added. If you also wish to settle the mobile number payments to this newly linked account, then you need to turn on All-in-one Settlement On by taping on it.

All future payments received will be credited to this new bank account.

Yes your Paytm QR, Soundbox & card machine will keep working after the 15th of March as well. If your QR code, Paytm Soundbox or Paytm Card Machine is linked to any bank account other than Paytm Payments Bank, you can continue to use this arrangement even after March 15, 2024. If they are linked to Paytm Payments Bank Account, then you will have to link the same to a bank account of another bank. Login to Paytm for Business app for the same.

You will continue to enjoy uninterrupted payments if your settlement Account is any bank other than Paytm Payments Bank. Incase of Paytm Payments Bank as a settlement account, the settlement in your existing Paytm Payments Bank Ltd. account will proceed without any issue until March 15, 2024. The balance in the account can be withdrawn even beyond March 15, 2024. However, we recommend that you change your settlement account in the Paytm for Business app from Paytm Payments Bank Ltd. to any other account held with other banks to ensure seamless settlements.

You can change your settlement bank account from Paytm Payments Bank account without interruption until March 15, 2024.

The Reserve Bank of India (RBI) has issued a directive which clearly shows no impact on your existing balances in Account or Wallet and your money is safe with the Bank.

Leave a Reply