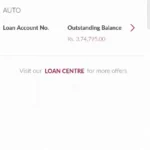

Are you thinking about making Axis Bank Loan Part Payment Online? Yes you can do it online without visiting the branch or the loan center. But before I explain the process in detail, lets try to understand what does the term part payment mean.What Is Part PaymentLets try to make the term Part Payment Simple by taking an example:Let's say you have a loan of ₹5 lakhs with a bank, and you currently have ₹1 lakh that you want to use to reduce your loan balance. By putting this ₹1 lakh … [Read more...]

How to Foreclose HDFC Credit Card EMI Online

Pre-Close or Foreclose HDFC Credit Card EMI could be opted if you wish to fully settle the EMI or No Cost EMI obtained on your credit card. The reasons for foreclosing a loan on an HDFC Credit Card may include a desire to save on interest charges or having sufficient funds available to clear the loan.The process for pre-closing or foreclosing HDFC Credit Card EMI or No Cost EMI is the same. Below are the complete steps to be followed if you wish to foreclose or pre-close your HDFC Bank … [Read more...]

HDFC Credit Card Not Supported on The Flipkart Big Billion Days

The Mega Shopping Event of the Year has started which is The Flipkart Big Billion Days. This Year the Card Discount Partner of the Flipkart Big Billion Days is HDFC Bank. So on using HDFC Bank Credit Card, Debit Card or Easy EMI, the user gets extra 10% discount or even more depending on the product category.But this year some of the HDFC Bank Credit Card's isn't providing the discounts. This may be due to the recent changes in the Bank's and eCommerce Terms and Conditions.When … [Read more...]

How to Close Paytm Payments Bank Account

In light of the recent ban imposed by the Reserve Bank of India (RBI) on Paytm Payments Bank, many account holders are seeking to close their accounts prior to the looming deadline of February 29, 2024. However, it is important to note that closing your Paytm Payments Bank Account will not disrupt other services provided by the company, such as Paytm Wallet, FASTag, Paytm Money, and various others.Close Paytm Bank Account OnlineHere's a step-by-step guide on how to effectively close … [Read more...]

How to Raise Dispute in Axis Bank Credit Card [Chargeback]

If an unauthorized transaction has occurred on your Axis Bank credit card, you can raise a transaction dispute. Chargeback request means you inform the bank about the suspicious charge so they can investigate and potentially reverse it. In this article, we will explain how to raise an Axis Bank credit card transaction dispute or chargeback request.You can raise a transaction dispute or chargeback in the following scenarios:Unauthorized Transactions: Transactions that you did not … [Read more...]

- « Previous Page

- 1

- …

- 3

- 4

- 5

- 6

- 7

- …

- 10

- Next Page »