Axis Bank Pre Approved Loan could prove as a blessing to those who doesn’t have a valid income documents. The requirement of a loan could arise at any point of time in your life. The purpose of applying for a loan may be numerous, but before applying for the loan the first thing which comes to your mind is: which bank will give you the loan, and what will be the documentation and criteria to apply for the loan.

So if you are worried about your eligibility to apply for a loan due to no income proof documents or less salary, etc., then there is an option called Pr-Approved loans. In this post, we will talk about the Axis Pre-approved loans which you can instantly apply online.

Table of Contents

What is Pre-Approved Loan?

A Pre-Approved loan offer is a loan offered by the bank by considering the borrower’s credit score, account history in the bank, net monthly balance maintained in the bank account, and many other factors. A pre-approved loan is an unsecured loan as the borrower doesn’t need to keep existing assets on a mortgage.

As compared to other types of loans, the Pre-Approved Loan requires very minimum documents or no documents, and once applied the amount gets disbursed instantly.

Benefits of Pre-Approved Loan

| No documents required (No Income Proof or ITR or Salary Slip) | Completely Online paperless process |

| 24×7 loan | Instant approval |

| Funds disbursed into bank account instantly |

Not all account holders are eligible to apply for the Pre-approved loan in Axis Bank. Credit score plays a major role in getting loan offers, but excluding credit score, there are several criteria taken into consideration by banks before the account holder becomes eligible for a Pre-approved loan offer.

How to get Axis Bank Pre-Approved Loan Offer

If you want to get an offer of Axis Preapproved Loan in your account, then you should fulfill the below criteria.

| Maintain a good and higher Credit Score | If you have availed credit facility with the bank then make sure you pay your dues on time |

| To achieve a higher credit score and a good credit history, get a credit card and pay the dues on time | Maintain a handsome amount in your bank account |

| Avoid applying for loans multiples time in different banks, this could negatively effect your credit score |

If you follow all these above tips then you may end up getting an offer of Pre-Approved Loan in your Axis bank account or any other banks.

Now let’s proceed with how to check and apply for pre-approved instant loan offers by Axis Bank.

Apply for Axis Bank Pre-Approved Personal Loan Online

As explained earlier, the Axis bank offers Pre-approved loans to selected customers depending on credit score, repayment history, and other criteria.

If you are entitled to a Pre-approved loan, then Axis bank regularly communicates through email about such offers. However, you can also always check online whether you have been privileged with a Pre-approved loan offer by the Axis bank.

How to Check Pre Approved Loan in Axis Bank: To check for Axis bank Pre-approved Personal Loan offers login to Axis bank internet banking or Axis mobile app. The process to check pre approved loan in axis bank mobile app as well as internet banking is same.

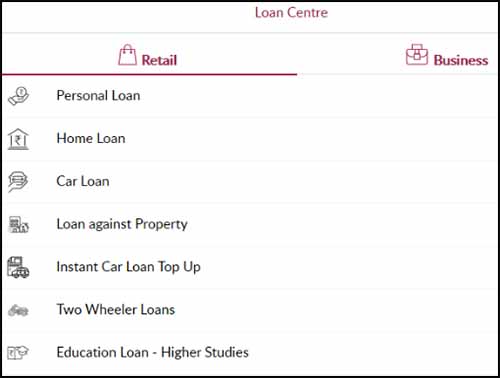

If you are logged in to Axis mobile app then just tap on the loans, this will navigate you to the Loan Centre page

OR

If logged in to internet banking, go to Apply Now > loans, this will open Loan Centre page

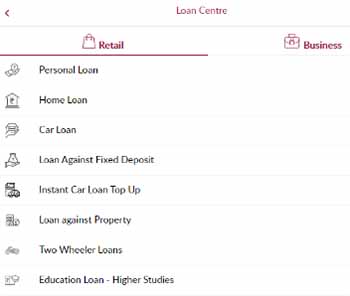

From the loan center page, you can select from various types of loans such as personal, home, car, instant car, two-wheeler, education, etc.

Select any type of loan from the displayed option to see the pre-approved offers

On selecting the type of loans, if you have been pre-approved with any loan offers then it will display loan offer on the next screen

As I was eligible for a pre-approved personal loan, so I will show you the complete process to apply for a pre-approved personal loan by Axis bank. If you are eligible for any kind of pre-approved loan then the process is almost the same.

Once you reach on the centre page, just click or tap on the Personal loan

If you are eligible for a pre-approved loan then it will display the loan offer with Pre-qualified amount

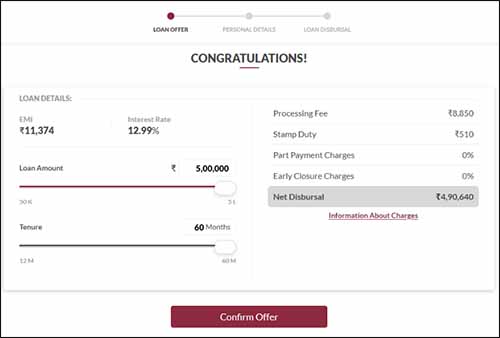

All the details of the pre-approved instant loan will be displayed such as Interest rate, EMI, processing fee, stamp duty, part payment charges, early closure charges, net disbursal, and also you will be able to customize the tenure and loan amount as per your need from the available limits

To check out information about several charges on the loan, you can just tap or click on the Information about charges

Once you make selection as per your preference for your personal loan, you need to just tap or click on the confirm offer button

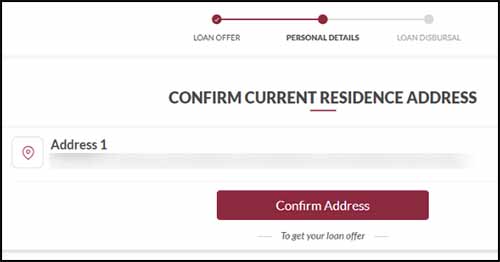

On the next page you will need to confirm your residence address, it will load your address registered with your bank account.

To proceed further just tap or click on the Confirm address button

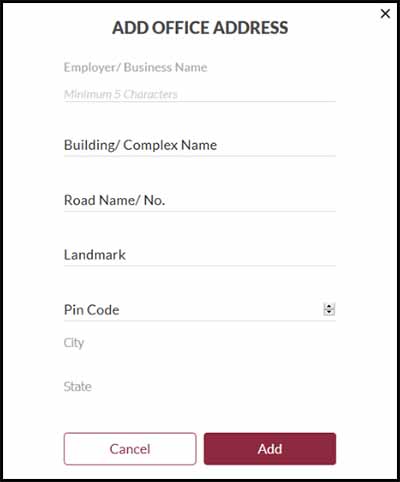

On the next page, you will be asked to enter your office address (just enter your office address by completing all the field, if you don’t have office address and you work from home then you can also enter your home address itself)

Once entering the office address, just tap or click on the add button

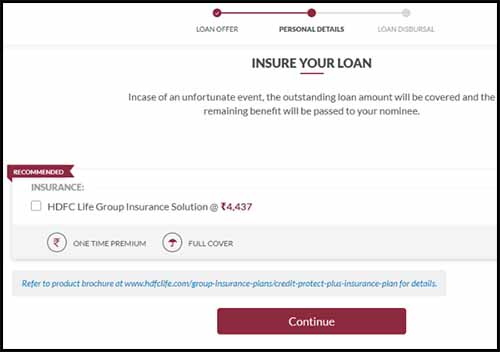

On the next screen you will get option to insure your loan (Incase of an unfortunate event, the outstanding loan amount will be covered and the remaining benefit will be passed to your nominee). Opting to insure your loan is optional, and if you select insurance then you will be charged one time premium as per the insurance company offers

If you don’t want to insure your loan then just skip selecting insurance offers and click or tap on the continue button

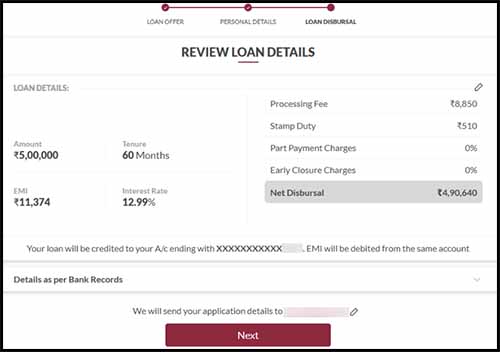

On the next screen you will get a chance to review the loan details like loan amount, tenure opted, monthly EMI, interest rate, processing fees, stamp duty, part payment charges, early closure charges, net disbursal, and details of your bank account from which the monthly EMI will be debited

Once you review the details, just tap or click on the next button

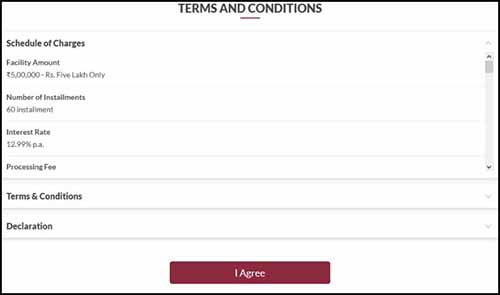

Once clicking on the next button, the terms and conditions of the loan will be loaded (this will mention all the terms and conditions of the loan offer, schedule charges, monthly EMI payment details, EMI cycle date, disbursement details, and declaration)

You should refer to all these details carefully, and if you agree then you need to just tap or click on the I agree button

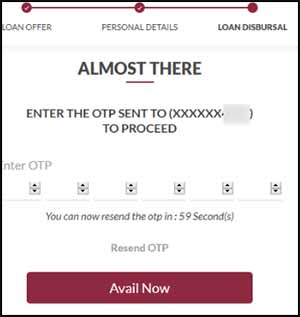

The next step will be the final step, where an OTP will be sent on your registered mobile number

So you need to enter the received OTP code on this final screen and click or tap on the avail now button

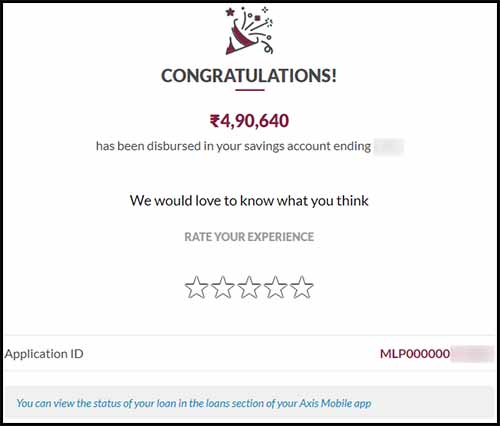

The loan amount will be instantly disbursed into your Axis bank account after deducting the processing and stamp duty charges.

You will also receive an email confirmation from Axis bank regrading the loan approved enclosing the Personal loan disbursed PDF file which will contain the terms and conditions, Schedule Of Charges, and declaration.

The details of your Personal Loan, along with the repayment schedule will also be sent to you in another welcome email by Axis Bank.

To view the attachment of your details of your Personal Loan, along with the repayment schedule, you will need to enter a password.

Your password will be a combination of the first 4 letters of your name in UPPER CASE as it appears on your Account Statement (ignore spaces if any) and the 4 digits of your DOB in DDMM format.

The loan account will be linked to your customer id in the next 24 hours, and you will be able to view and manage your loan account through internet banking or Axis mobile app.

The EMI will be deducted from your linked Axis bank account on the scheduled EMI repayment cycle date, so you will need to maintain the balance in your bank account.

Apply Axis Bank Pre Approved Car Loan

If you are getting email’s/ SMS and notifications in Axis mobile app stating you are eligible for Pre-qualified instant paperless car loan then you can be a brand new car owner in upcoming days. The maximum Pre-qualified amount issued to you for Car loan will also be mentioned on the same notification or message. So below are the steps which you will need to initiate to apply for car loan get all new car delivered to you in next few days.

If you are having a Pre-qualified Car Loan in your account then you need to first make a decision which car do you want to purchase. Once you have finalized the card and the variant, you will need to get quotation of the car variant from the dealer from where you wish to buy the card and quotation should include details like ex-showroom price, insurance and RTO Charges.

Once you have the quotation available with you, just follow the next step.

Login to your Axis Bank Internet Banking account or login to the Axis Mobile app

Once you are landed on the Dashboard page, just click on the apply now tab

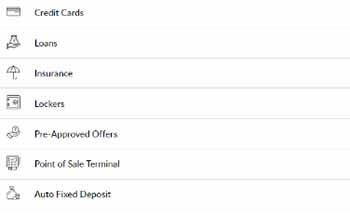

The apply now page will present all Axis Bank Products

From the list of the products just click on the Loans

On the next screen all types of loans will be presented, from the list just click on the Car Loan

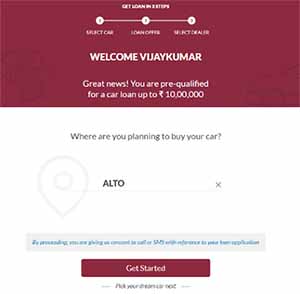

On next page, you will get to see a message “Great news! You are pre-qualified for car loan up to ₹XXXXXXXXX“

So the limit displayed is the maximum amount car loan which you can apply, if the car value is less then the limit then you can select the desired loan amount and apply for it. If in case your car price is more then the limit issued to you then you cannot proceed further with this pre-approved method and instead you will need to process your application by visiting the branch.

On the Welcome page, your location will be loaded from your bank account. So here you will need to just click on get started button.

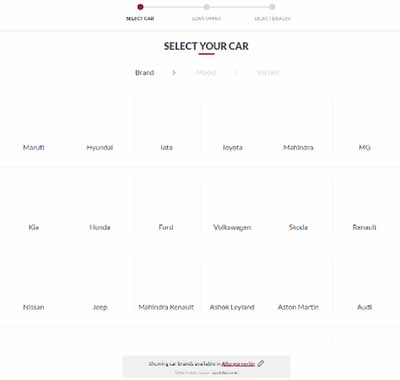

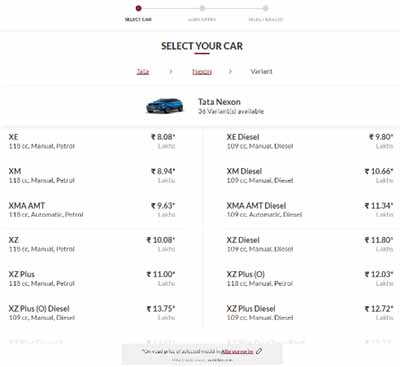

On the next screen you will need to select your car brand > model > variant

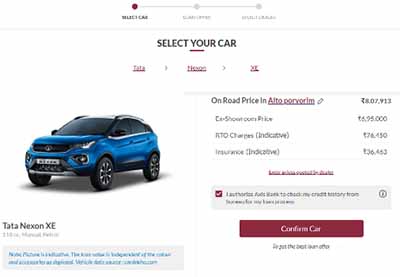

Once you have made these selection, you car model will be displayed with pricing fetched from the carddekho portal, so this price won’t be accurate as per your area and dealer

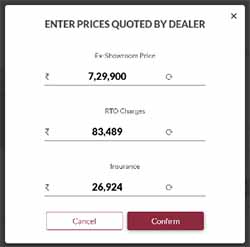

So here you will need to click on Edit prices quoted by dealer and type the prices in the Ex-Showroom Price, RTO Charges, and Insurance field as per your dealers quotation and click on the Confirm button

Review the entered details if it is entered correctly without any errors

By default “I authorize Axis Bank to check my credit history from bureau for my loan process” will be ticked mark (this means your CIBIL Score will be accessed by the bank). So you need to just leave it as it is and click on the Confirm Car button.

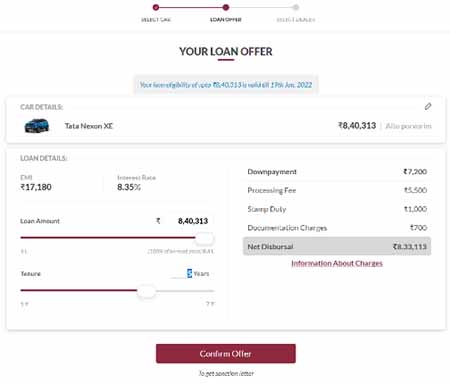

On the next screen, you will have to select the loan amount whether you want to finance 100% of on road price or will make some down payment.

Once you have done selecting the loan amount, select the tenure of the loan by sliding the slider.

The interest will also be calculated and displayed on the same page, so that will be interest of your car loan.

On the right hand side column, the processing fee, stamp duty and documentation charges will be calculated and this amount will be deducted from your loan amount. So after deducting the amount the net disbursal amount will be mentioned below which will be credited to the dealers account, the amount deducted as a loan charge from the loan amount can be paid to the dealer by yourself at the time of delivery of your car or as per dealers instructions.

You can view more information about various charges on your Car loan by clicking on the Information about charges

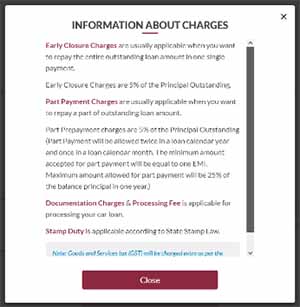

The information about charges pop-up will show all the charges and fees applicable to your car loan such as Early Closure Charges, Part Payment Charges, Documentation Charges, Processing Fee, Stamp Duty, etc.

If you agree with these charges and proceed your application, just click on the Confirm Offer

On the next screen an add-on will be visible which is insure your loan, this life insurance policy will bear the risk of loan repayment in case of untimely demise. So you can add this policy to insure your loan by paying a one time payment as mentioned on the screen. It is not mandatory to insure your loan, you can even skip it.

Once taking decision whether to insure your policy just click on the Continue button

On the next screen your loan details will be displayed with your address

If all details are appearing correctly just click on the Next button

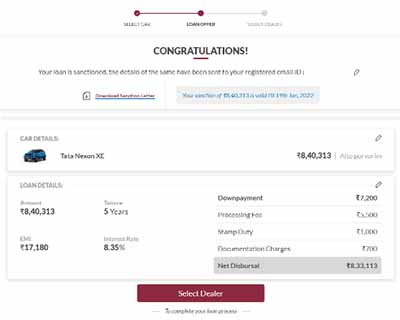

On next screen a Congratulations! message will appear stating “Your loan is sanction, the details of the same have been sent to your registered email ID”

From the same page, you will be also able to download the Sanction letter by clicking on the Download Sanction Letter

The Sanction Letter will be in PDF format which will contain all the details of your loan sanctioned, terms and conditions and the charges applicable. The Sanction letter downloaded from this page won’t carry and password protection, but if you have downloaded the PDF Copy of sanction received through email then you will need to enter the password to open it which will be first four letters of your name in capital letters followed by date and month of your birth.

You need to download and keep this Sanction letter safely with you for future reference

Next on the same screen you will be able to see Select dealer button, just click on that button and select the dealer from where you have bought the quotation

Once selecting the dealer just click on confirm dealer

Your application will be submitted and soon you will receive a call from Axis Bank Sales representative for document collection.

Your loan reference number will display on the screen as well as it will be mentioned on the sanction letter.

Next you will need to submit the quotation, cross cheque leave, pan card copy, and any other identification document to the bank representative

You will be also asked to signature on several documents, so better read all he documents on which you are been requested to sign and then only proceed further

Once done with documentation and signature your loan will be processed by the bank and the amount will get disbursed to the dealers bank account.

Once the amount is disbursed to the dealers account, you will need to communicate with the dealer to further process the delivery of your car.

On the Auto Loan disbursal day itself you will receive welcome email from bank stating “Congratulations! Your Auto Loan has been disbursed” and the same email will include the attachment of your Account Information of your Auto Loan in PDF Format which will be password protected. To view the account information you will need to enter the below password combination:

Your password is a combination of first 4 letters of your name in UPPER CASE as it appears on your Account Statement (ignore spaces if any) and the 4 digits of your DOB in DDMM format.

This account information PDF file will contain all details of your loan account including loan account number, charges, fees, terms and conditions and repayment schedule. So you can keep this file safely stored on your device for future reference.

How to Foreclose Axis Bank Personal Loan

If you want to completely pre-close your personal loan, then you need to clear the remaining outstanding due. Below are the complete steps which you need to follow to foreclose or pre-close the Axis Bank Personal Loan. The below process is explained as per my experience which I have gone through while closing my personal loan.

As per the Personal loan which I was been issued, it was having no extra charges on part payment or early closure, so before you proceed to request for closure you need to check this out with your bank or refer to the terms and condition documents which were issued.

To Pre-close your Axis Bank Personal loan you will need to visit the nearest Axis Bank Loan Centre, the closure request of loans are not entertained at the Axis Bank branch. I had personally visited the branch and they said that closure requests can only be raised at the Axis Bank Loan Centre.

To submit the loan pre-closure request you will need to take the cheque or cash, registered mobile number, your identity proof document, and your loan account number along with you.

Once you visit the the loan center, just request the executive that you need to pre-close your personal loan

You will need to provide your loan account number to the executive, and they will tell you the pending due amount which you need to pay

You can pay the outstanding amount via cheque or cash, if you are paying by cheque you need to fill up the cross cheque leaf, entering the exact outstanding amount

Once you fill up the cheque , submit the cheque to further process your request

You will receive a message on your registered mobile number in which you will find a number to which you will need to give a miss call

So to further process your request you need to give a ring to that number which you have received via message within 5 minutes, as that number will be valid for 5 minutes

Once you have successfully given a miss call, the executive will be able to further process the request of your loan foreclosure

Your identity proof document will be requested, which they will scan for the verification purpose

Once the process is done, you will instantly receive an SMS on your registered mobile number stating “Your request no XXXXX related to loan closure has been registered on loan a/c PPRXXXXXX. It will be processed by XX-XX-2021”

So you are done submitting the request for loan foreclose or preclose, your loan will be closed by the given date as stated in the message

You will also receive the loan statement through email

Once the cheque is cleared and the outstanding amount is deposited in your loan account, your loan will be closed

And once your loan is closed, you will receive Personal Loan No Dues Letter which is also known as NOC through email in PDF format

That’s it, this is how you can foreclose your Axis Bank Personal Loan.

If the account is opened between the 1st to 4th of the month then the EMI Cycle will be 10th of the same month

If the account is opened between 5th to 26th of the month then the EMI Cycle will be 5th of the next month

If the account is opened between 27th to 30th/31st of the month then the EMI Cycle will be 10th of next month

While applying for the pre-approved loan a standing instruction will be set up with your linked bank account for loan EMI repayment.

Foreclose of Axis bank personal loan cannot be done online. But to pre-close the loan, you need to visit the Axis bank branch or loan centre.

If the EMI due date falls on a bank holiday then the EMI will be debited on the next working day.

Axis Bank Pre approved Personal Loan is disbursed into bank account instantly.

You can’t check pre approved loan in axis bank by sms, the available modes with which you can check pre approved loans in axis bank are via net-banking and Axis Mobile app.

Leave a Reply