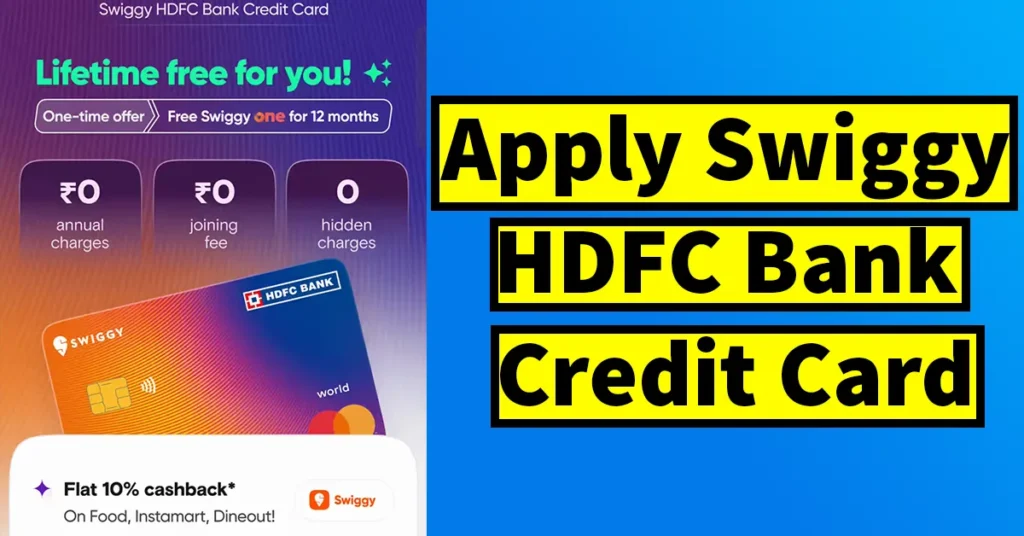

If you’re a regular Swiggy user, the Swiggy HDFC Bank Credit Card can help you save a significant amount on your purchases. With 10% cashback on food orders, Instamart, Dineout, and Genie, those small savings can quickly add up over time.

In this post, you’ll learn how to apply for the Swiggy HDFC Bank Credit Card, check the eligibility criteria, and understand the benefits associated with the card.

Table of Contents

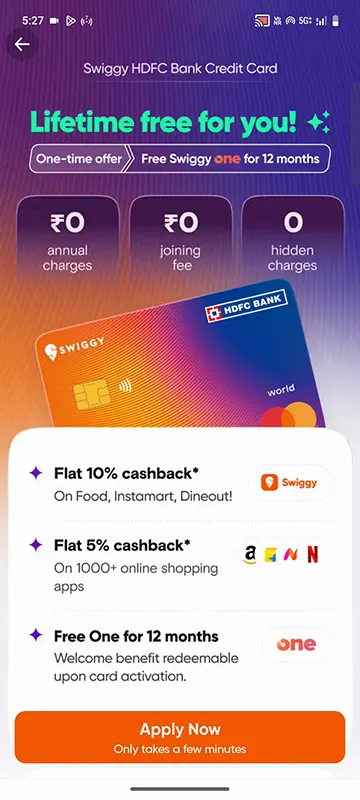

Swiggy HDFC Bank Credit Card Benefits

1% Cashback on other categories. [View exclusions and cashback capping.]

10% Cashback on the Swiggy app (Food Orders, Instamart, Dineout & Genie). [Click here for more details.]

5% Cashback on online spending across selected MCCs. [View the list of eligible MCCs.]

Eligibility Criteria

To apply for the Swiggy HDFC Bank Credit Card, you must meet the following criteria:

| Category | Minimum Age | Maximum Age | Minimum Income Requirement |

|---|---|---|---|

| Salaried | 21 Years | 60 Years | Net Monthly Income > ₹15,000 |

| Self-Employed | 21 Years | 65 Years | ITR > ₹6 Lakhs per annum |

How to Apply for the Swiggy HDFC Bank Credit Card

Swiggy HDFC Bank Credit Card can be applied directly from the HDFC Website, as well as through the Swiggy app itself. But for regular users of Swiggy app, sometimes the Swiggy HDFC Bank Credit Card is offered lifetime free without any annual charges. And if you want to know the trick to get this Swiggy HDFC Bank Credit Card Lifetime Free then keep reading the post, as i am going to reveal the trick later in this post.

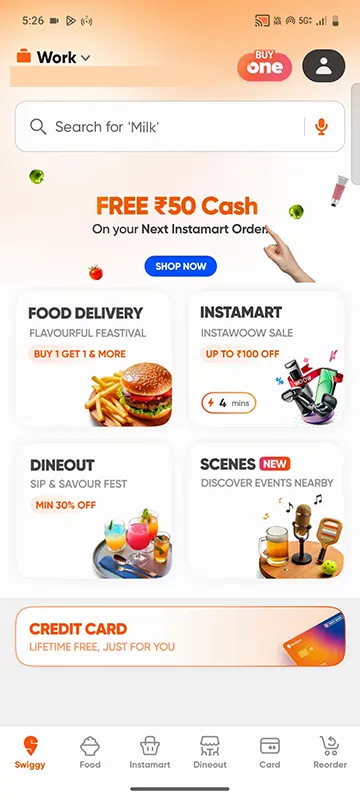

Assuming you are already an Swiggy user, open the Swiggy app. If you are existing HDFC Bank customer then make sure the same mobile number is linked with your Swiggy account and if not then login using the same mobile number in Swiggy app which is registered with the HDFC Bank. If you are not a HDFC Bank customer then you may skip this and login using any of your mobile number.

Once you have launched the Swiggy application, on the homepage itself you will be able to see a Swiggy HDFC Bank Credit Card Banner. Tap on it to begin with your application process. And if you are unable to see this banner then tap on your Profile, and under your Profile page tap on Swiggy HDFC Bank Credit Card. This will also take you to the application page of Swiggy HDFC Bank Credit Card.

On banner if you are able to see Lifetime free then it means it will be a LTF Card without any annual charges. And if you are able to see annual charges then you aren’t eligible for LTF Card. In such case what you can do is tap on the Apply button and come back. This will intimate the app that you are interested in this card but not proceeding with the application and in few days you will also able to see LTF offer in your app.

Once you have tapped on the banner, you will be able to see Swiggy HDFC Bank Credit Card Features and Benefits, tap on the Apply Now button appearing below.

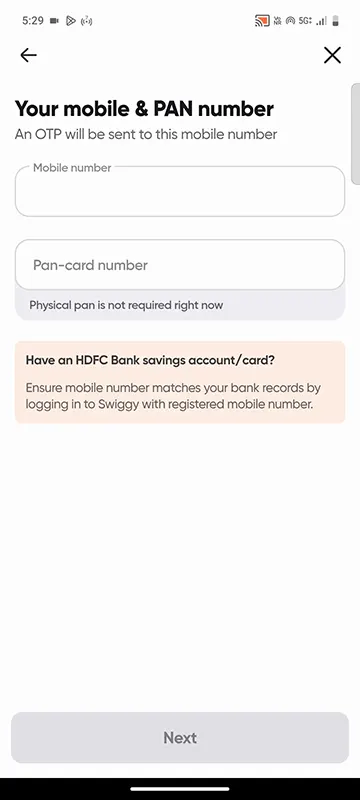

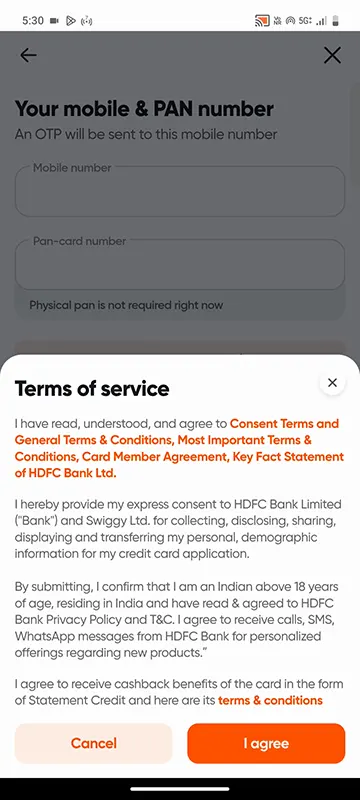

On next page you will need to enter your PAN, your mobile number will be auto populated and won’t be able to edit as it will be fetched from your Swiggy account.

Once entering the PAN tap on the next button

Terms and Service details will be popped up, tap on the I Agree button

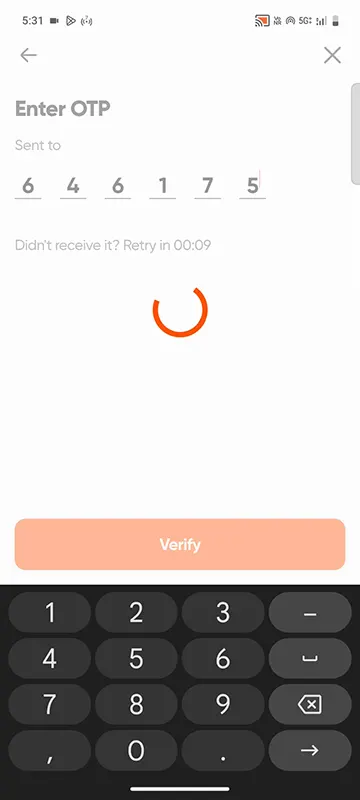

A One time password will be sent on your registered mobile number, enter the received OTP Code and tap on the verify button

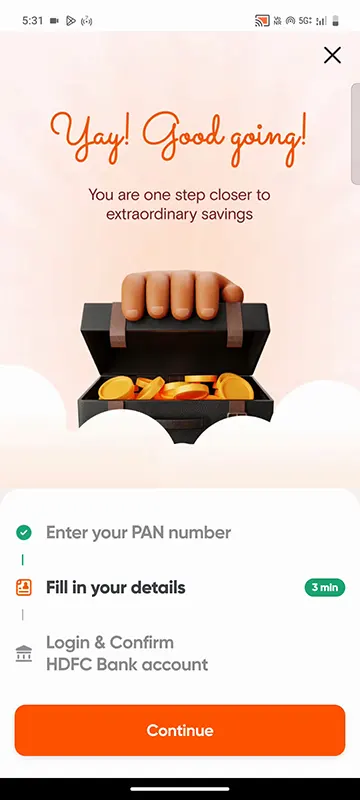

Tap on the Continue button to begin filling in your details,

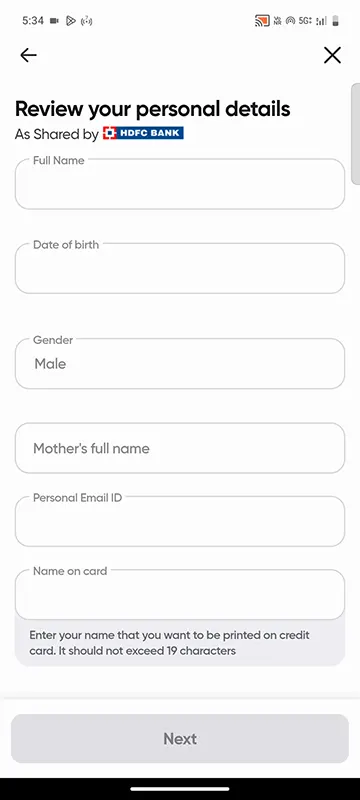

Your name, date of birth and gender will be loaded as per PAN or registered in HDFC bank if you are a HDFC Bank account holder.

Enter your Mothers Full name, the Personal Email id will be loaded which is registered with bank.

You may mention the name on card to be appeared and tap on the next button

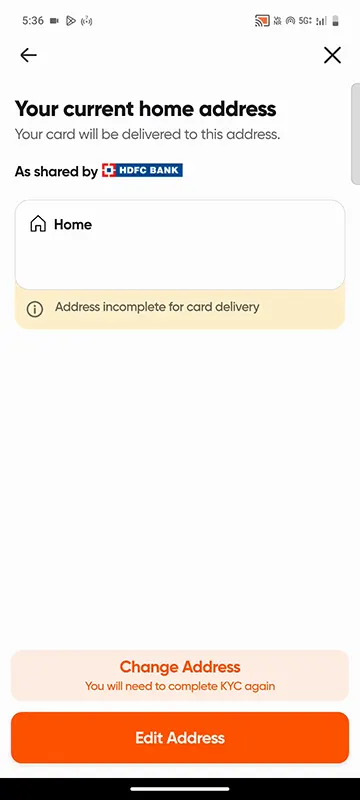

On next page you current home address will be displayed as registered with bank, you can tap on change address or tap on edit address.

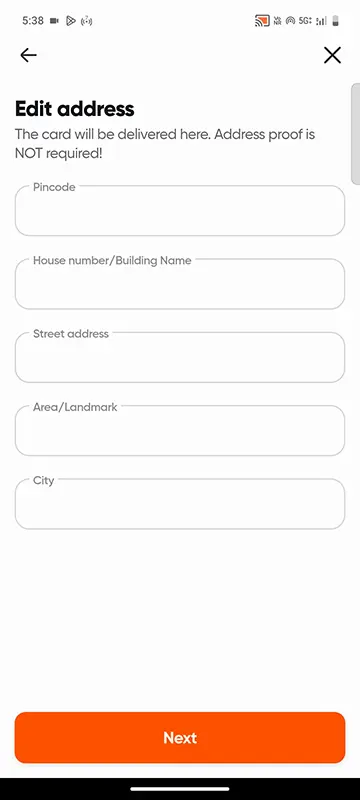

If you have selected edit address enter your complete address, and tap on the Next button

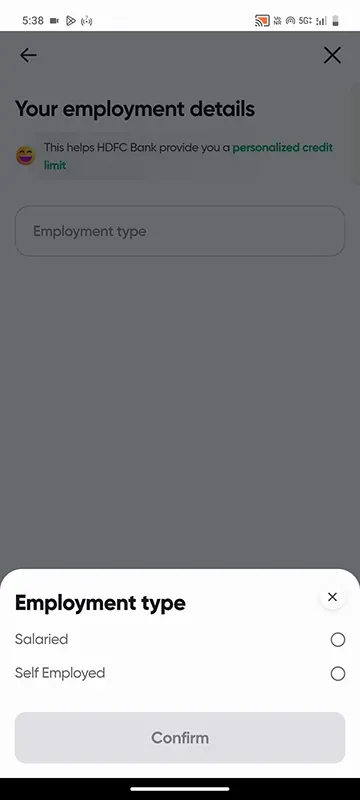

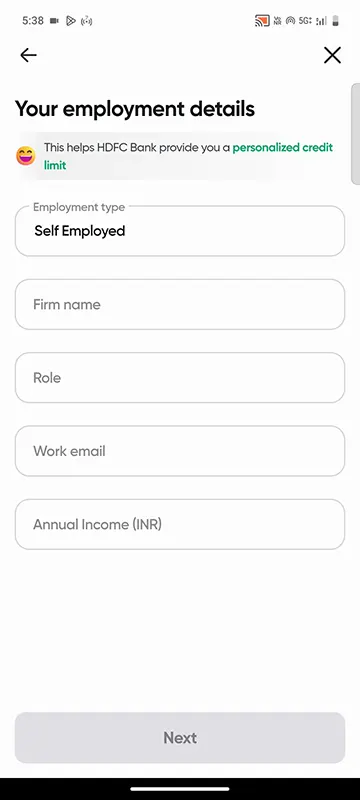

On next page you will need to enter your employment details, from employment type select from salaried or self employed and tap on confirm

If Selected Self Employed then fill in your firm name, role, work email, and annual income,

If Selected Salaried enter, company name designation, work email, annual income

Once entering the details, tap on the next button

A message will be displayed checking your application with HDFC Bank it usually takes less than 5 minutes. Please don’t close the app or press back button. You need to wait patiently until this completes

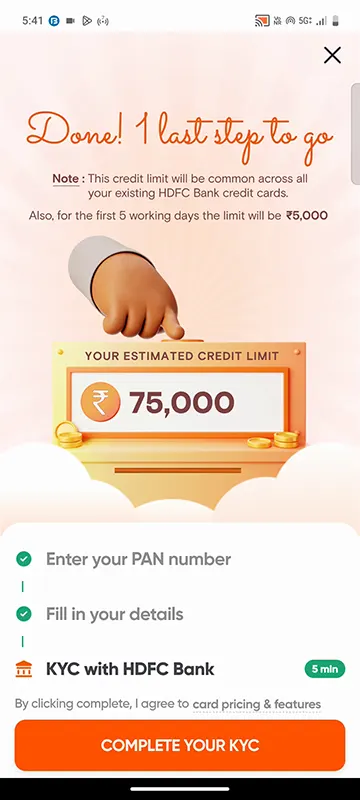

On next page you will be displayed with your estimated credit limit on your card.

To proceed tap on Complete your KYC

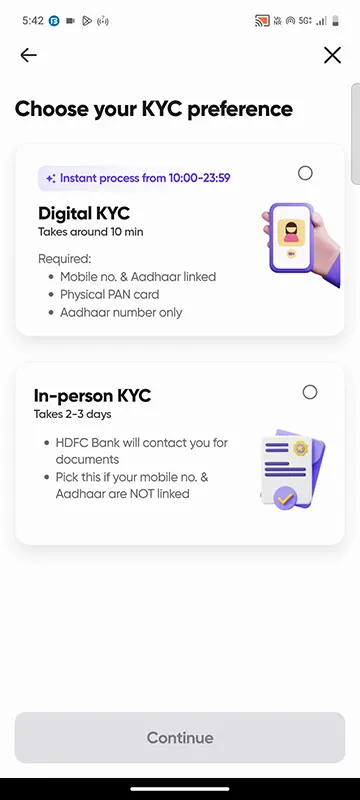

On next page you will need to make selection for your KYC Preference from Digital KYC or In-personal KYC

Digital KYC will be done online using Aadhaar and linked mobile number which would take 10 minutes and for in person KYC HDFC bank will contact you for documents and pick this if your mobile number and Aadhaar are not linked in 2 – 3 days.

Here lets select Digital KYC and tap on the Continue button

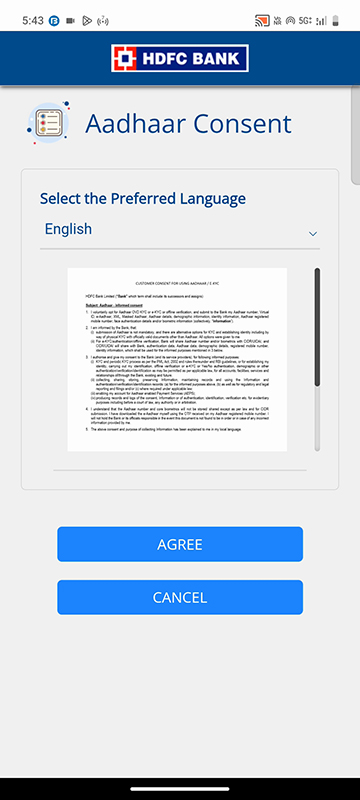

An Aadhaar Consent document will open, you may refer to it and tap on the Agree button

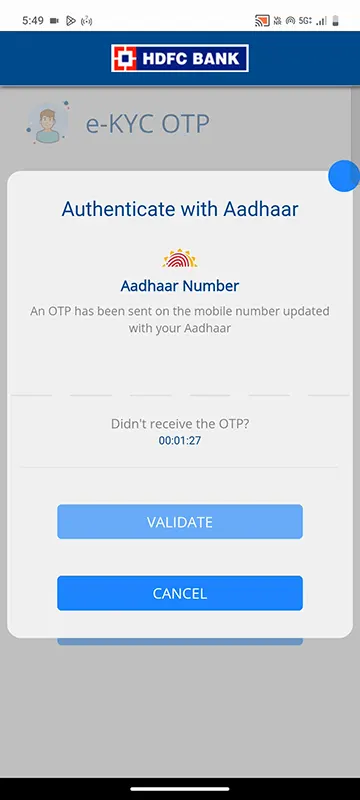

On next page you need to make selection of Aadhaar Number or Virtual ID, select any of the option which you have available with your and enter the Aadhaar Number or VID and tap on Generate OTP button

A one time password will be sent on your registered Aadhaar mobile number, enetr the received otp and tap on the validate button

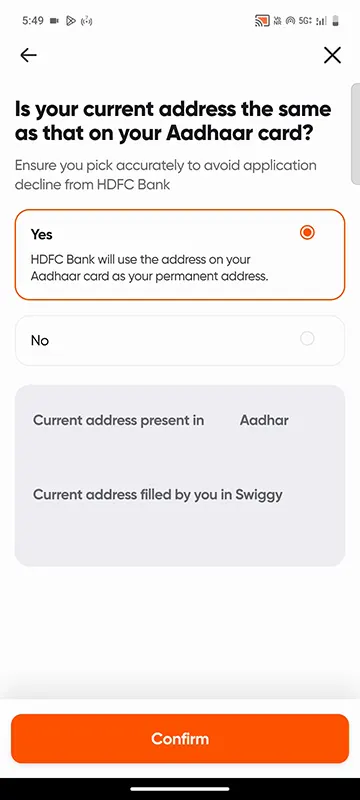

On next page you will need to confirm if your current address is same as that on your Aadhaar. Select YES and tap on the confirm button.

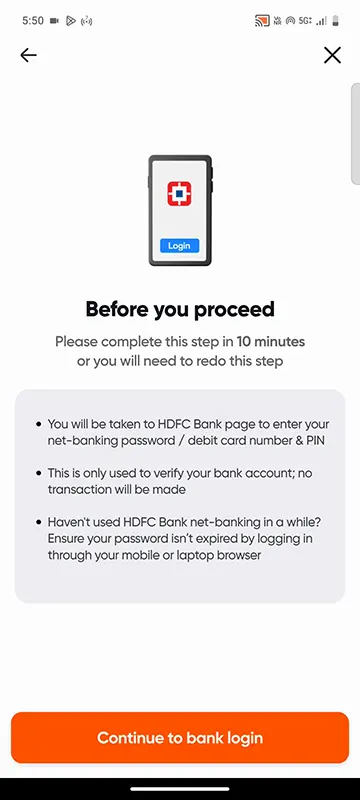

The last and the final step will be if you have HDFC Bank Account you need to login using HDFC Bank Net banking or debit card number and PIN to verify

Tap on the Continue to bank login

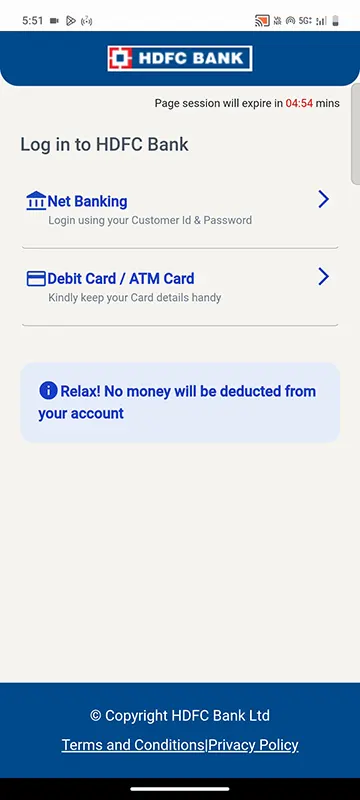

On next page you need to make selection from Net banking or Debit/ ATM Card

Select your preference to login, here i selected Net banking

Enter Net banking credentials such as customer id tick mark on I agree and acept the terms and conditions and tap on login and verify button

Next enter your password/ipin and tap on the login button

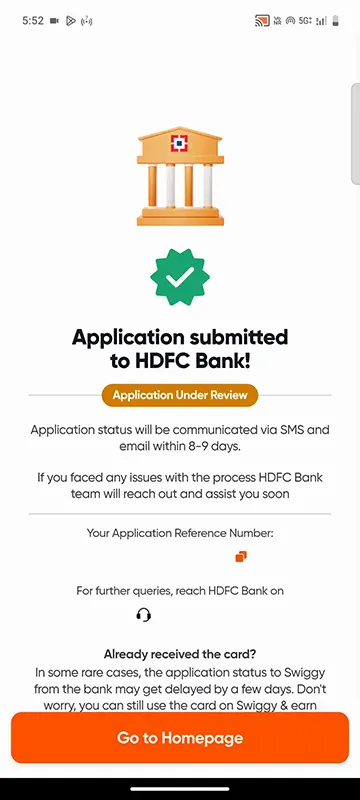

On next page you will be able to see your application submitted to HDFC Bank message and its under review

The application status will be communicated via SMS and email within 8 -9 working days. And below there will also be a reference number which you can use to track your application.

You can even track your application status from your Swiggy app itself by going to Swiggy HDFC Bank Credit Card section by tapping on banner or the Profile Section Swiggy HDFC Bank Credit Card and tap on View Application Status

Once your application is approved you will be able to see the Swiggy HDFC Bank Credit Card in your HDFC Bank net banking and mobile banking app.

And the card will also be dispatched to your address in 2 -3 working days after approval of your application.

Leave a Reply