Are you thinking about making Axis Bank Loan Part Payment Online? Yes you can do it online without visiting the branch or the loan center. But before I explain the process in detail, lets try to understand what does the term part payment mean.

Table of Contents

What Is Part Payment

Lets try to make the term Part Payment Simple by taking an example:

Let’s say you have a loan of ₹5 lakhs with a bank, and you currently have ₹1 lakh that you want to use to reduce your loan balance. By putting this ₹1 lakh towards your loan, you’re either trying to pay off your loan sooner or lower your monthly EMI payments. This kind of extra payment made towards your loan is called a Part Payment or Partial Payment.

Axis Bank Loan Partial Payment Charges

If you are planning to make Partial Payment on any of your Axis Loan Account such as Personal Loan, Auto Loan, Education Loan, Home Loan etc. the bank may levy partial payment charge + GST on your Part Payment Amount which you would make towards the Loan Account. The Partial Payment Charges will be stated on your Loan Sanction Letter. However some times the bank also do offer loan with zero part payment and zero foreclosure charge, and if you had taken such loan then you won’t be charged any Loan Partial Payment Charges.

How to make part-payment towards Axis loan account

To make part-payment towards any kind of Axis bank loan account there are two options provided by the Axis Bank, and they are visit the branch / loan center or pay it online. Note down that bank may charge you some fee to make part-payment or foreclose payment towards your loan account, but while taking a loan if you were offered with 0% Part Payment and Early Closure Charges then you won’t be charged any fee.

Make Axis Bank Loan Part Payment Online

To make part-payment online open the Axis mobile banking app

If you haven’t registered on the app, then setup your account using your account details

Login to your account

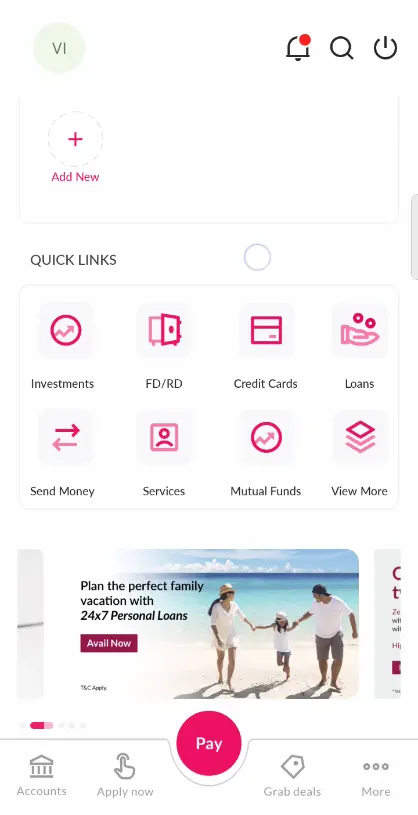

From homepage scroll down, under Quick Links tap on Loans

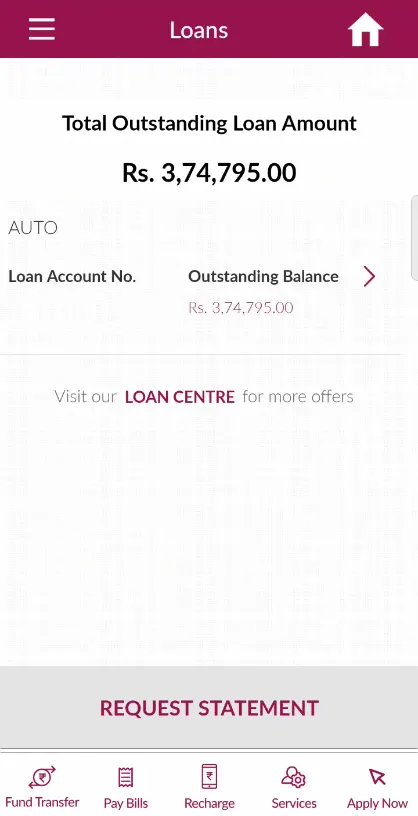

Your loan account will be displayed

Tap on the Loan account

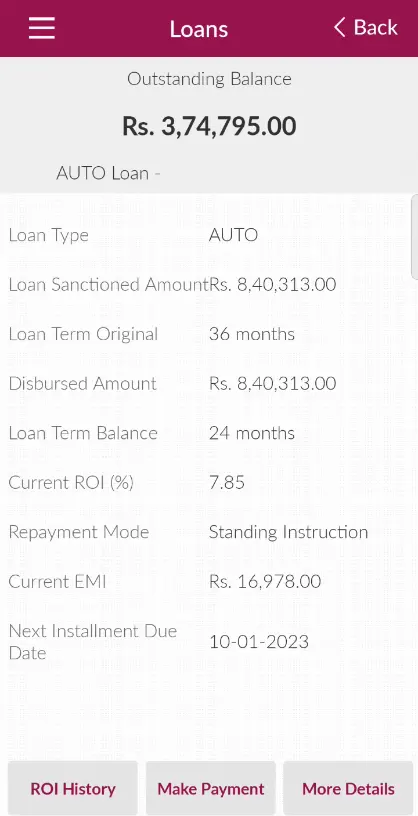

Your loan details will be presented, on this page at the bottom tap on the Make Payment button

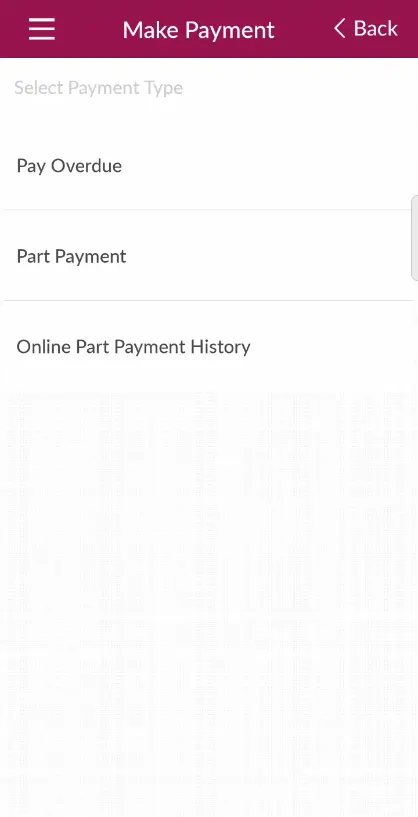

On next screen there will be three options, from these three options tap on the Part Payment

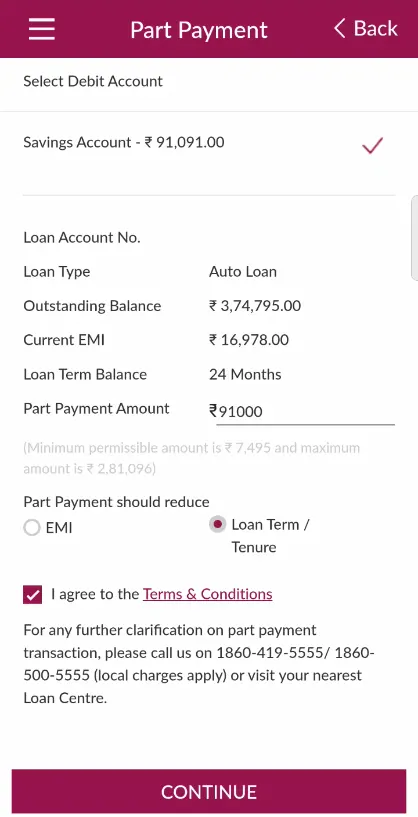

On the next page, your outstanding balance, current EMI, loan term balance details will be presented

From the first option you need to select the debit account if your are holding multiple savings account under one customer id or if you only hold one savings account then the account will be selected by default

In the part-payment amount box you need to enter the part payment amount which you wish to make, the minimum permissible amount and maximum amount will be mentioned below so accordingly you need to enter the amount

Once entering the amount, select the part payment should reduce EMI or Loan Term/ Tenure

Accept to the terms and conditions by tick marking on it and tap on the continue button

But before you proceed make sure you have sufficient balance in your savings account to make the payment payment.

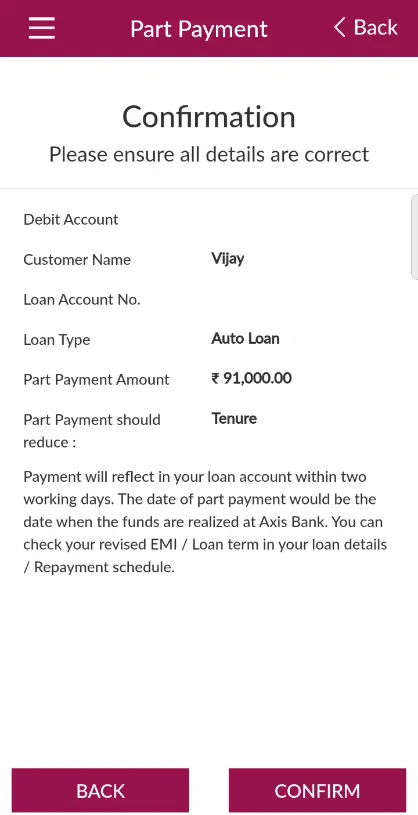

On next screen a confirmation will be displayed to ensure all the details are correct. To confirm and continue tap on the Confirm button.

You will prompted to enter your mPIN of Axis Mobile app to process the request

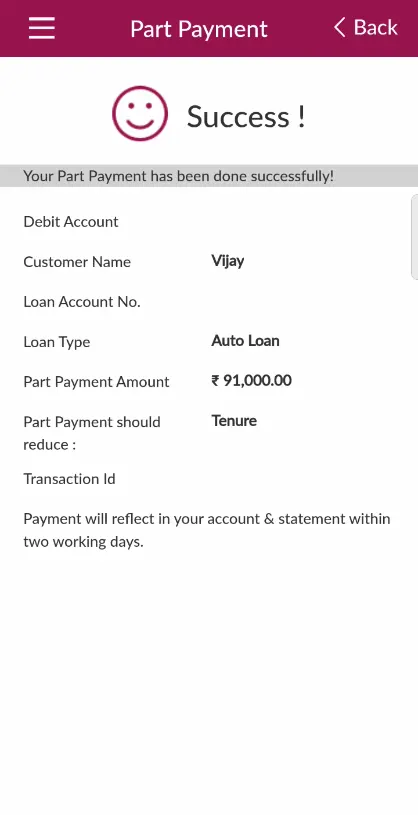

Once entering the mPIN “Your Part Payment has been done successfully” message will appear with details like Debit Account, Customer Name, Loan Account No., Loan Type, Part Payment Amount, Part Payment should reduce, and the transaction id.

Note down to check the loan due date. Part Payment is not allowed on or within 5 days of due date. You can make payment after 5 days of due date.

If you’re not comfortable making the online part-payment for your Axis Bank loan, you can always go the traditional route by visiting a branch or loan center to make the payment in person. If you wish to know the process of offline mode of making Axis Bank Loan Part-Payment then you can follow the below steps.

Make Part-Payment by Visiting Branch or Loan Center

Take a deposit slip from the branch, fill it up duly with your details. Make sure in account field you mention your loan account number and mention the form of payment whether cash or cheque

If you are issuing cheque then in the name field you will need to write Axis bank Ltd and your loan account number

Mark the cheque as a cross cheque, write the amount & submit it along with the deposit slip

If you are depositing cash then the amount will be reflected in your loan account under unadjusted section in few hours, and if you have issued cheque then it will be updated in one working day once the cheque gets clear

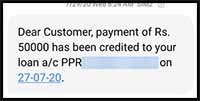

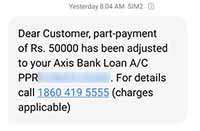

Once the amount is deposited in your loan account, you will receive an SMS from the bank

After amount deposits, the amount will be reflected under unadjusted amount which you can view in net banking or Axis mobile app

Once the amount reflects under UN-adjusted or once you get notification of deposit, you need to call the Axis customer care and navigate to the loan section

You need to verify your details with the customer care line, and then you can ask request for part-payment of the deposited funds

The customer care will ask you whether you want to reduce your loan tenure or reduce the monthly installments (EMI)

Select whichever you wish, but reducing the tenure will be beneficial

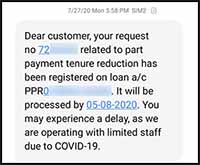

Once you place a request you will instantly receive your request number through SMS

The un-adjusted funds will be adjusted towards your loan account as a part-payment in 1 -3 working days

Once the amount is adjusted as part-payment, you will receive the notification via SMS as well as you can also check it through netbanking or Axis mobile app

Yes, you can make part-payment towards Axis bank loan online with the help of Axis Mobile Banking app. Earlier the option to make part-payment online wasn’t available, but now this feature has been added in the Axis mobile banking app.

The minimum amount must be above the EMI amount and the maximum amount can be 90% of your loan amount which you can pay as part payment towards your loan account.

You can make one part payment per month towards your Axis loan account.

If you were offered zero percent Part Payment and Early Closure Charges while taking the loan then you won’t be charged any fees to make a prepayment.

Charges are applicable depending on when you wish to foreclose your loan:

Within 12 months of availing loan – 5% of prepayment being made

13 – 24 months – 4%

25 – 36 months – 3%

More than 36 months – 2%

Leave a Reply